Gold’s Hidden 5x Paradox …

He called gold’s rise to $3,200 when most said it was the stuff of fantasy. Now he’s uncovered a unique way that could help investors achieve significantly more … without buying an ounce of gold.

Dear Reader,

If you’re invested in gold …

And have watched your holdings nearly triple in the last three years …

Or …

You missed gold’s recent run and are now looking for the next chance to make good …

It’s important you pay attention to what I’m about to reveal …

Because our expert says the gold bull market is starting to move into its next phase.

Something he is specifically calling the “Golden Paradox”.

The reality is …

Gold has been, and continues to be, red hot.

But we are going to show you why the next stage of this bull run …

Has nothing to do with the yellow metal itself.

As a matter of fact …

Historically, investors could have performed extremely well …

Without buying a single ounce of gold.

Now, I know this might seem strange.

After all …

Every talking head out there is telling you to buy gold.

From celebrities like Dr. Phil and Tucker Carlson …

And what seems like every commercial on cable news networks.

Heck, you can even buy gold at your local Walmart.

It’s a feeding frenzy right now.

Those who buy into this overblown hype …

Could miss out on the real winners.

Because they do not understand the Golden Paradox.

Truth be told …

Many in the financial world don’t understand it either.

That’s why many Wall Street analysts and insiders were shocked by gold’s rise this year.

But not us.

Our experts have been successfully recommending gold investments for nearly 100 years.

Our track record shows we have a good sense of what will happen next.

Historically, during every gold bull market …

The same scenario has played out.

Gold goes on a tear.

Before it begins to plateau.

That’s when another investment takes off.

And the gains are significantly higher than gold …

It’s happened like clockwork …

Every.

Single.

Time.

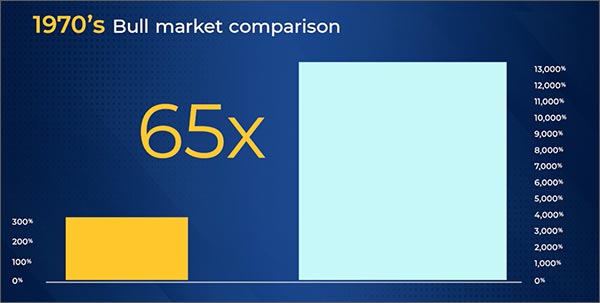

65 Times Better Than Gold …

Go all the way back to the early 1970s.

After President Nixon ended the gold standard …

The precious metal broke out.

Kickstarting a decade long bull market …

That saw gold nearly triple.

However …

Once gold hit its peak …

It passed the baton to this unique investment.

Who ran with it.

Rising by over 13,000% in that same time frame …

That’s 65 times higher than gold climbed.

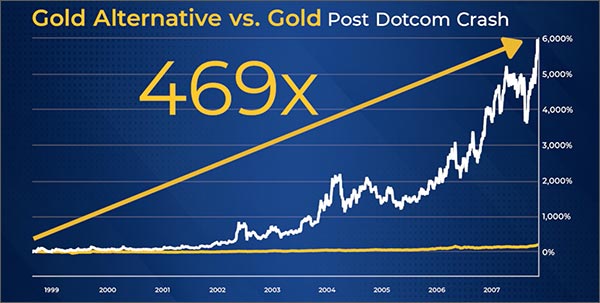

It happened again in the early 2000s coming out of the dotcom crash.

Gold took off over for several years.

But …

Those who owned this other asset …

Could have made 469 times more than those who bought gold itself.

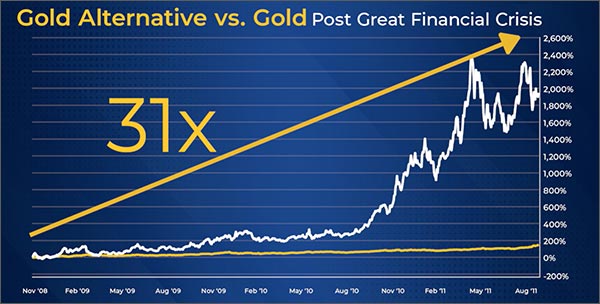

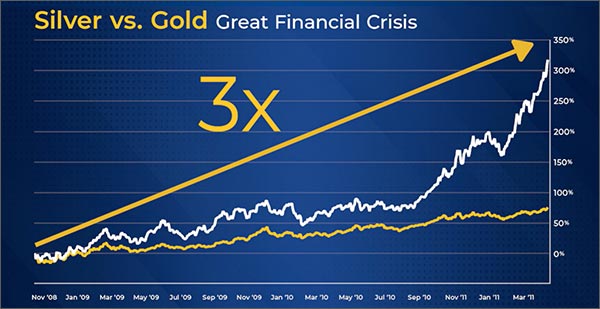

The trend continued in 2008.

The housing market collapse triggered the Great Financial Crisis.

Sending gold on a multi-year bull run.

During which time it nearly tripled in value.

But, just like every time before …

This other speculation soared much higher.

Those who bet on it could have made as much as 31 times more …

Then all those who poured their money into the yellow metal.

That’s a result any investor would be over the moon with.

Yet as incredible as it may seem …

The last time this Golden Paradox played out was even more impressive.

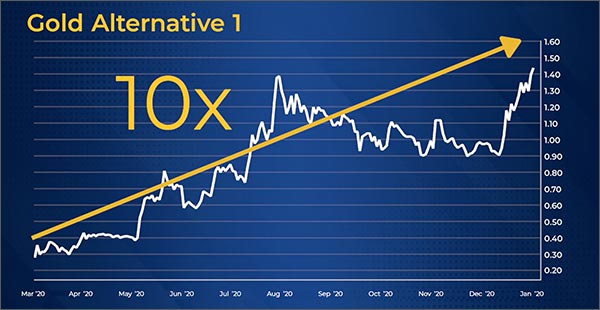

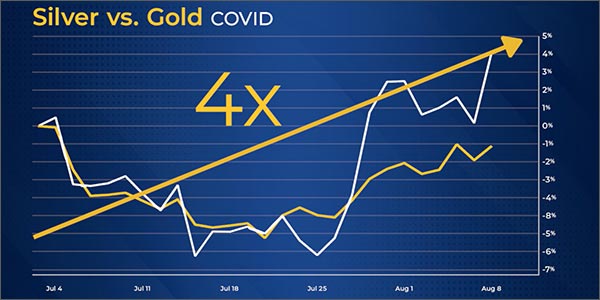

As the COVID crisis raged between February and July of 2020 …

Gold went up again.

However …

This special asset class provided multiple chances to blow gold gains away.

Investors who understood this Golden Paradox …

Had more than a half dozen chances to beat gold …

Including Avino Miners, which was 10 times higher.

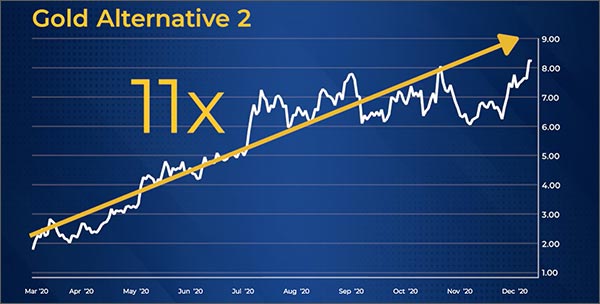

Fortuna Silver went up 11 times more than gold.

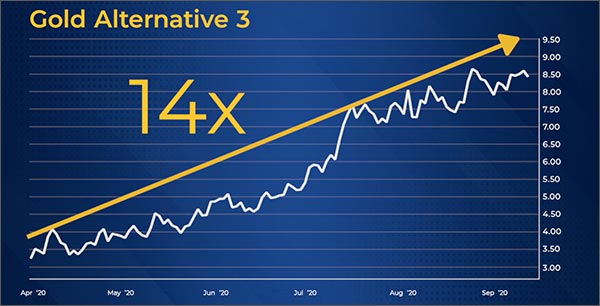

Silver Corp Miners soared 14 times more than gold during that time frame.

Of course, these are exceptional examples …

But they are a sign of what is possible.

Now …

Our expert says we’ve reached what he’s calling the Golden Paradox phase again.

Gold is beginning to level off.

If history is any indication …

This gold alternative is on its way to the top of the mountain.

Except this time …

We are seeing an extra tailwind powering its rise.

With the potential to propel it to unimaginable heights.

One of the Largest Bull Markets in Recorded History …

Some big time names on Wall Street have seen this Golden Paradox develop.

And are racing to position themselves ahead of it.

Plunging huge amounts of cash into this special, non-gold, asset class.

Names like BlackRock and JP Morgan …

Are spending hundreds of billions of dollars on it.

As are Amazon, Google and Microsoft through their data center investments.

In fact …

The list of major financial firms who want in on the action …

Seems to grow by the day.

Names like Goldman Sachs, Citigroup and Morgan Stanley.

Or Barclays, Merrill Lynch and Credit Suisse …

I could go on and on.

And it’s not just big Wall Street firms.

Since 2019 …

Nearly $60 billion from retail investors has poured into this market …

Including $5 billion in 2025 alone.

All because they understand the Golden Paradox.

But if you weren’t one of them …

Don’t worry.

Many industry insiders believe this is only the beginning.

Philippe Gijsels of BNP Paribas, one of the top 10 banking firms in the world, said …

“We are still closer to the beginning than to the end of what could well become one of the largest bull markets in recorded history.”

So …

If you’ve been riding the golden wave the past few years …

Or are one of those who missed out and are looking for a shot at redemption …

We’ve been gifted a second opportunity.

Because gold’s climb is slowing …

Potentially paving the way for another precious metal to soar …

I’m talking about silver.

Better than Gold, Nvidia and Bitcoin

You may have heard about silver’s surge in the news recently.

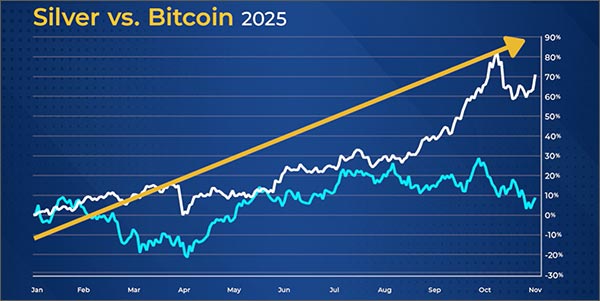

It’s already up 70% for the year.

Outpacing not just gold …

But some of the tech giants who are driving the S&P 500 to new heights.

Including Nvidia and Broadcom.

It’s even crushing Bitcoin …

Which also hit a new all-time high this year.

Case in point …

Silver just passed its previous record high.

A number not seen in almost 50 years.

And just like gold …

Many on Wall Street have been caught off guard by silver’s recent upswing.

However …

Those of us who understand the Golden Paradox …

Have seen this move coming from a mile away.

As I said before …

Our firm has been nailing successful calls on gold markets for decades.

And we’ve watched silver swing past gold every time.

During the 1970s bull market …

It did nearly two and a half times better than the yellow metal.

It beat it again during the dotcom crash.

Silver rose nearly three times higher than gold during the Great Financial Crisis.

Coming out of the COVID crisis …

Silver was almost FOUR times better than gold.

Again, a result any investor would have been thrilled with.

However …

The Golden Paradox has a hidden layer.

And those who uncover it …

Will discover a unique investment that has crushed gold in recent years …

And has even outperformed physical silver.

This could be the best way to turbocharge a portfolio.

All thanks to the Golden Paradox.

And no one knows how to play this better …

Than our own gold market guru …

Sean Brodrick.

They’ve nailed the top and bottom of every gold market for over 20 years …

As a matter of fact …

Sean was well ahead of Wall Street and the mainstream media on gold’s current run.

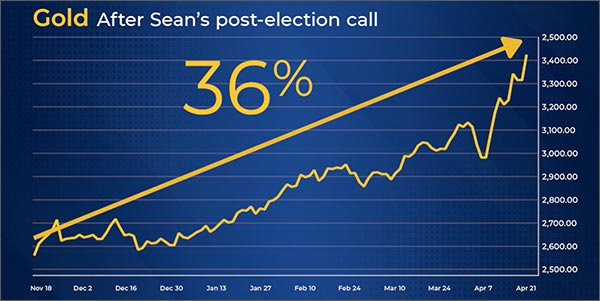

Shortly after Trump’s election …

Sean predicted a significant event would soon happen.

One that would send gold soaring.

Pushing it past the $3,200 mark.

Many laughed at Sean when he said gold was going to rise by more than $1,000.

But Sean stuck to his guns …

Trusting his decades of experience in precious metals.

Sure enough …

Gold busted through the $3,200 barrier …

Just like he said it would.

Honestly …

Sean’s prediction was so accurate …

It happened within 48 hours of when he said it would.

Gold soared 36% in just five months right after Sean’s call.

It’s this type of acumen …

That makes Sean perhaps one of the most sought after gold analysts in the business.

He’s appeared on CNBC, Fox Business and Bloomberg amongst others.

And has spoken at major financial events all over the world.

Including the New Orleans Investment Conference …

One of the oldest and most respected investment gatherings on the planet.

As well as the highly exclusive Metals Investor Forum in Vancouver, amongst others.

In fact, Sean is so good …

His team has nailed the top and bottom of every single gold bull market …

For the better part of 20 years.

Sean even wrote a best seller on the topic.

It’s no wonder why tens of thousands of people hang on Sean’s every word …

Particularly when it comes to gold.

That’s why today is such a special treat.

Sean is about to join us.

To give us the nitty gritty on why silver is the best way to play the next phase of this run.

As well as how investors who have used this strategy …

Could’ve seen even better gains than just buying silver and gold alone …

Sean, it’s an absolute pleasure to get to sit down with you today.

I’ve been looking forward to this for quite some time.

SEAN: Thanks, it’s great to be here, Chris.

It’s an exciting time to be involved in precious metals.

CHRIS: It sure sounds like it, Sean.

Especially with the run that both gold and silver have been on.

Which of course leads us to the big question that surely must be on everyone’s mind.

What is this Golden Paradox?

SEAN: I’m glad you asked because it’s crucial to understand it.

Especially if you want a chance to make huge gains in a commodities bull market.

However …

Once you break it down, it’s more like a pattern than a paradox itself.

CHRIS: Interesting, how so Sean?

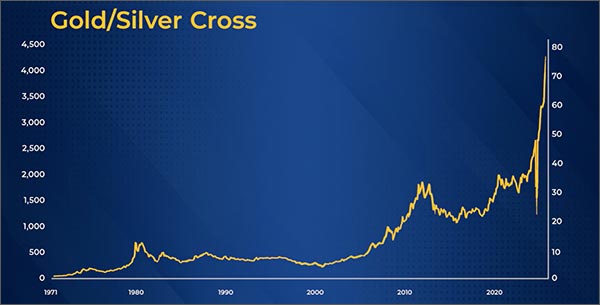

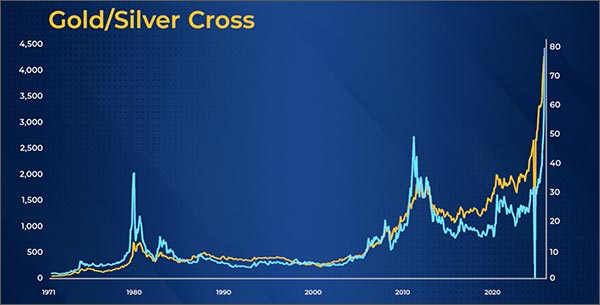

SEAN: To put it simply …

In every single gold bull market, the same pattern appears.

First. gold breaks through a key resistance level.

Surging exponentially higher …

Before undergoing a correction that brings it back down.

It’s at that point …

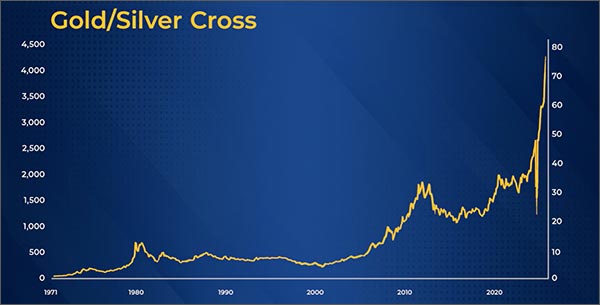

That the Silver cross appears.

CHRIS: The Silver cross?

SEAN: Yup.

As soon as gold nears or enters its correction phase …

That’s when silver begins to surge.

Not only crossing gold …

But surpassing it.

CHRIS: Ahh, I see.

And you’re saying this happens every single time gold goes on a run?

SEAN: Precisely.

And the Paradox is …

As gold soars, most people will see gold’s rise and pour money into it …

That isn’t necessarily the right answer.

As gold is reaching new levels …

That’s the time when the yellow metal slows down and silver takes off.

Let me show you.

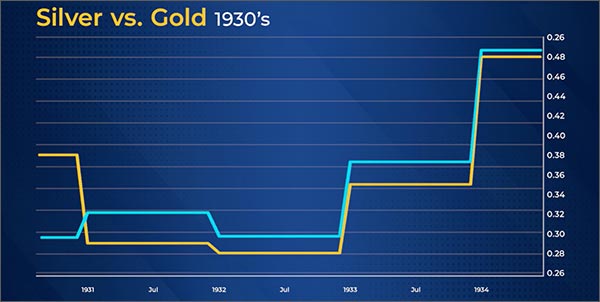

My firm has been nailing gold predictions since the Great Depression.

And that’s how long this Golden Paradox has been happening.

You can see it here in the mid-1930s …

And again when gold shoots higher in the mid-1960s.

CHRIS: So this isn’t just a modern trend you are talking about?

SEAN: Not at all.

It’s a historical pattern that’s been happening for the better part of a century.

CHRIS: That’s fascinating Sean …

Something I’d guess most investors don’t know about.

But seeing these charts now it makes total sense.

SEAN: It’s simple to understand once you really dig in with a fine-tooth comb.

In fact, the deeper I dug into this pattern …

The more I realized there’s an added bonus inside of these paradoxes …

Particularly as they continue to occur.

CHRIS: Well, leave it to an expert like you to find something beneath the surface.

Please, enlighten us.

SEAN: I’d be happy to.

Because it makes precious metals investors like me giddy.

In the past 50 years, each time this Silver Cross has appeared …

The gains for silver compared to gold get bigger and bigger.

For example …

In the peak rally in the late 1970s …

Silver did two and a half times better than gold.

During the Great Financial Crisis …

The gains were nearly three times higher.

By the time the COVID Commodities boom was over …

It was four times greater.

Now …

The Silver Cross of this current market just happened.

Gold has begun its correction …

And silver is starting to make its move.

CHRIS: It sounds like this is an opportune time to get involved.

But what does this all mean for investors specifically, Sean?

Should they dump all their gold for silver?

SEAN: Oh heavens no, Chris.

Listen …

I still believe gold has a lot of runway left.

In fact, I think it’s going to touch the $7,000 mark in the not so distant future.

But …

I strongly urge investors not to get caught up in the hype.

They shouldn’t rush out and buy those gold and silver coins you see advertised on tv.

Because there is a much better way to play this market.

CHRIS: Wait a second Sean.

I noticed you said both gold AND silver coins.

SEAN: Good observation, Chris.

Just like with silver …

There’s a better way to play gold’s rise than just buying it at Walmart.

And I’ll explain that in just a minute.

But right now …

There’s a niche inside this soaring silver market that is oozing with opportunity.

Beyond just the traditional pattern of the Golden Paradox.

CHRIS: Okay, that’s an interesting tidbit of information.

Can you elaborate?

SEAN: Absolutely.

I’m talking about the mining companies themselves.

These are the plays that could help investors score some massive wins in this red-hot market.

A History of Gains of 1,000% or Higher …

CHRIS: Interesting, how so?

SEAN: You see …

Most of the silver miner production costs happen at the very beginning.

The big expenditures for infrastructure …

Equipment …

Processing facilities, etc.

They don’t really change as silver goes up or down.

Therefore …

When the price of the white metal heats up like it has …

That’s when their value skyrockets.

CHRIS: And this is something that has happened previously?

SEAN: Absolutely.

When the Silver Cross has appeared …

Some high-quality mining stocks shot through the roof.

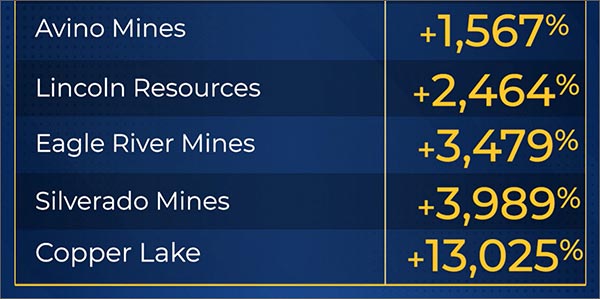

Go all the way back to the 1970s market.

Between December of 1978 and September of 1980 …

Over 20 different miners more than doubled in value.

Like ASARCO Incorporated, which went up 158%.

Homestake Mining soared 258%.

Silver Standard gained 333%.

Sunshine Mining Company, 558%

Hecla Mining Company, 935%.

CHRIS: Wow, those are some massive winners in such a short period of time.

SEAN: That’s only scratching the surface, Chris.

Nine different miners went up by more than 1,000% in this period.

Including Avino Mines, which climbed 1,567%.

Lincoln Resources took off for a 2,464% gain.

Eagle River Mines, up 3,479%.

Silverado Mines, a 3,989% winner.

Even Copper Lake, which skyrocketed an astonishing 13,025%.

CHRIS: Wow, those exceptional examples are enough to get our attention.

But I want to point out that was 50 years ago.

Have those types of gains been available in the bull markets after?

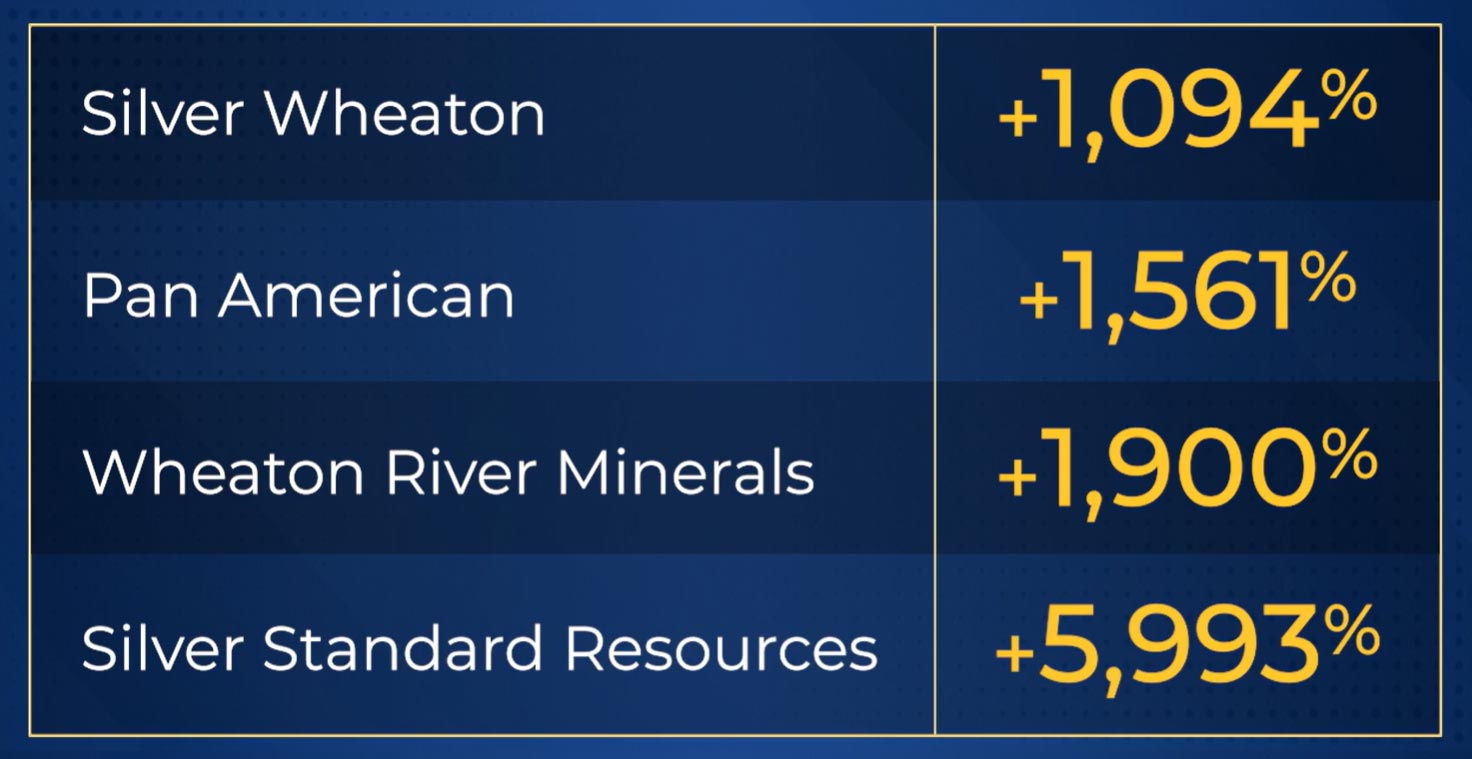

SEAN: Oh yes, Chris.

It’s not just isolated to that gold run.

As I said, when the Silver Cross shows up …

Silver miners take off.

It happened in the late 90s/early 2000s after the dot com crash.

Silver Wheaton gained 1,094% in just under three years.

Pan American Silver rose by 1,561% in seven years.

Wheaton River Minerals increased 1,900% in nine years.

Silver Standard Resources climbed as much as 5,993% in nine years.

That’s 31 times better than physical gold did during the same period.

During the Great Financial Crisis, it was more of the same.

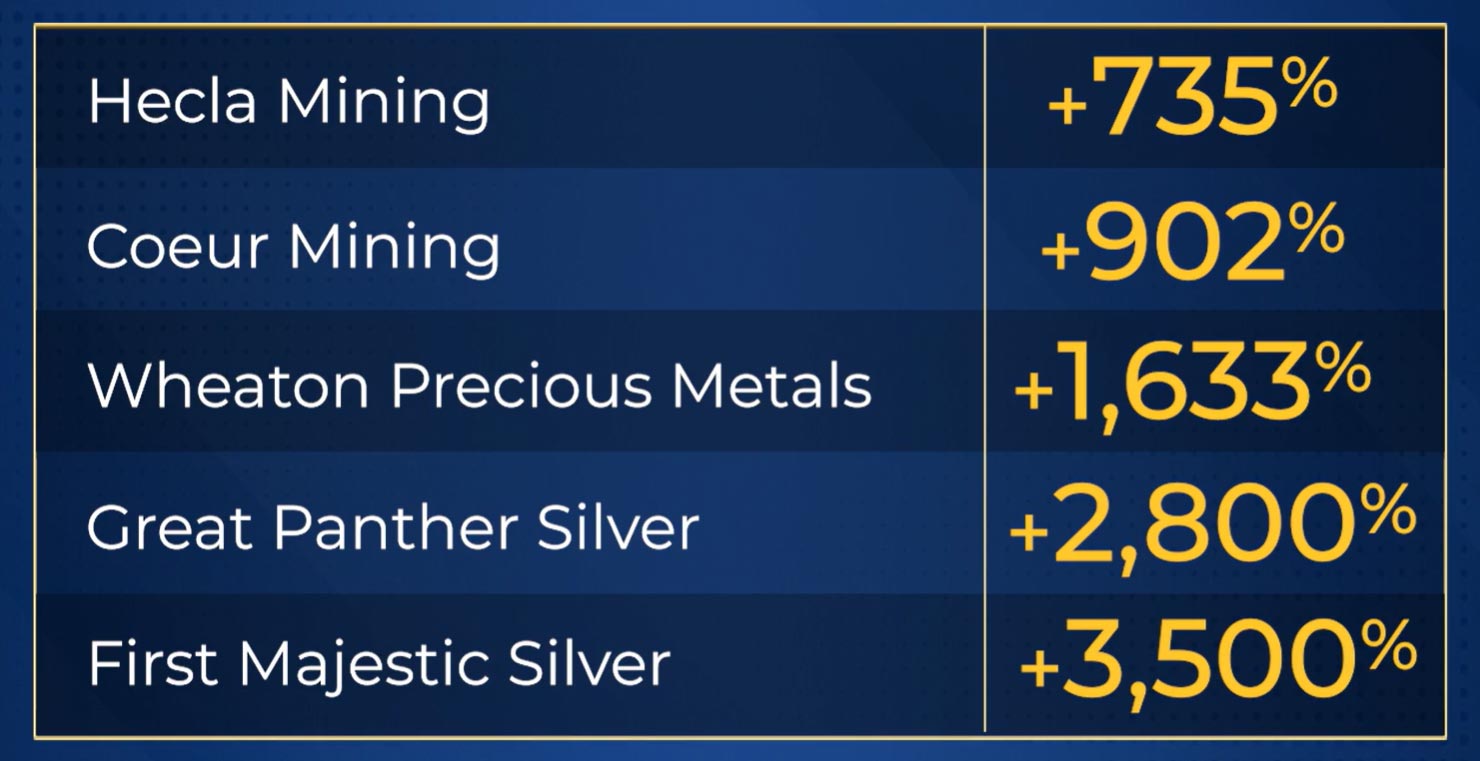

Hecla Mining shot up 735% in just over a year and a half.

Coeur Mining increased by 902%.

Wheaton Precious Metals rocketed up 1,633%.

Great Panther Silver climbed 2,800%.

First Majestic Silver ascended 3,500%.

All over a 3 year span.

CHRIS: Okay, this is not just a coincidence.

It’s a clear historical pattern.

And I assume more of the same during the COVID rally?

SEAN: I’d say yes and no, Chris.

And the only reason I’d say no is because it was a much shorter rally comparatively.

But even during that brief bull market.

Some miners flew higher at warp speed.

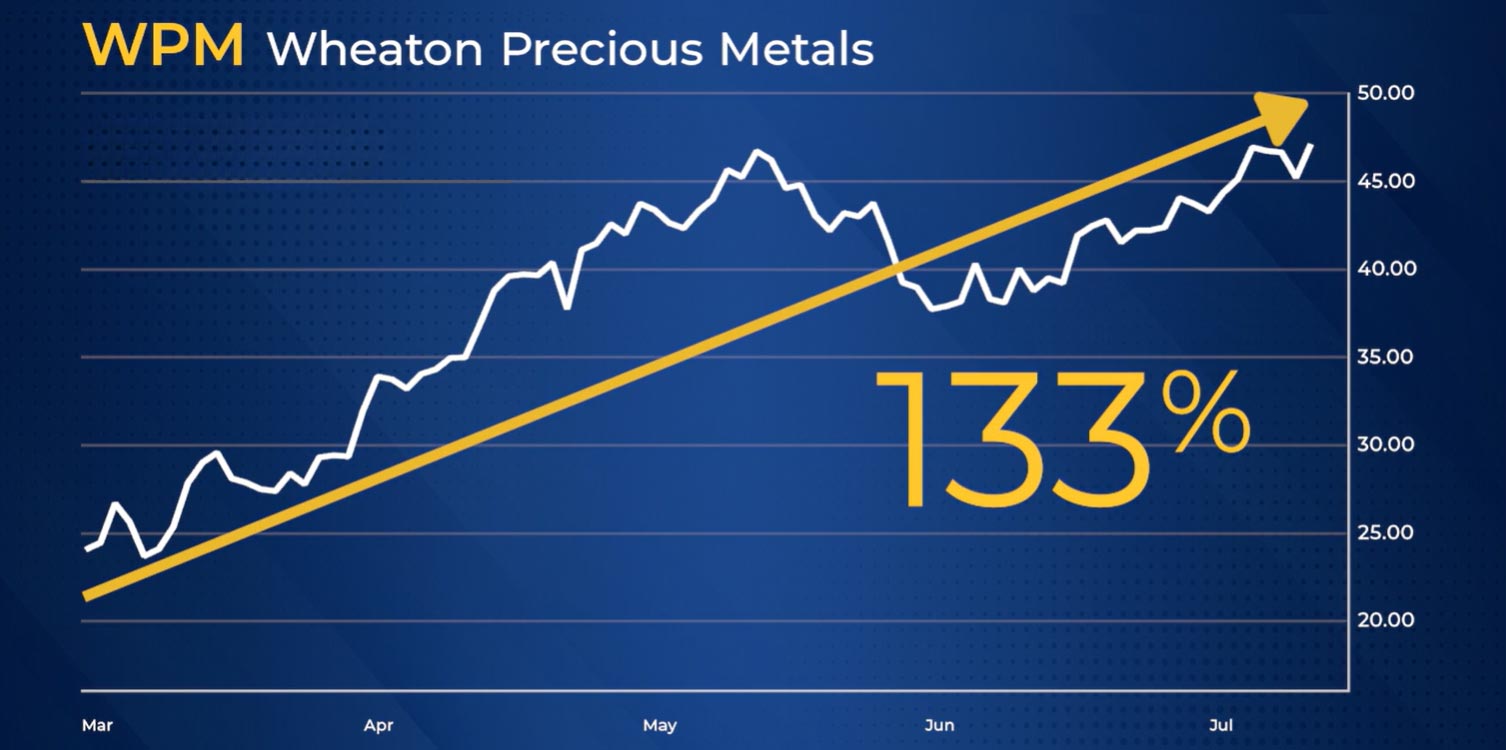

Wheaton Precious Metals went up 133% in a little more than four months.

Fresnillo Silver soared 151% in under six months.

First Majestic Silver climbed 229% in ten months.

Avino Silver ripped 357% higher in less than a year.

Fortuna Silver Miners skyed 430% in nine months.

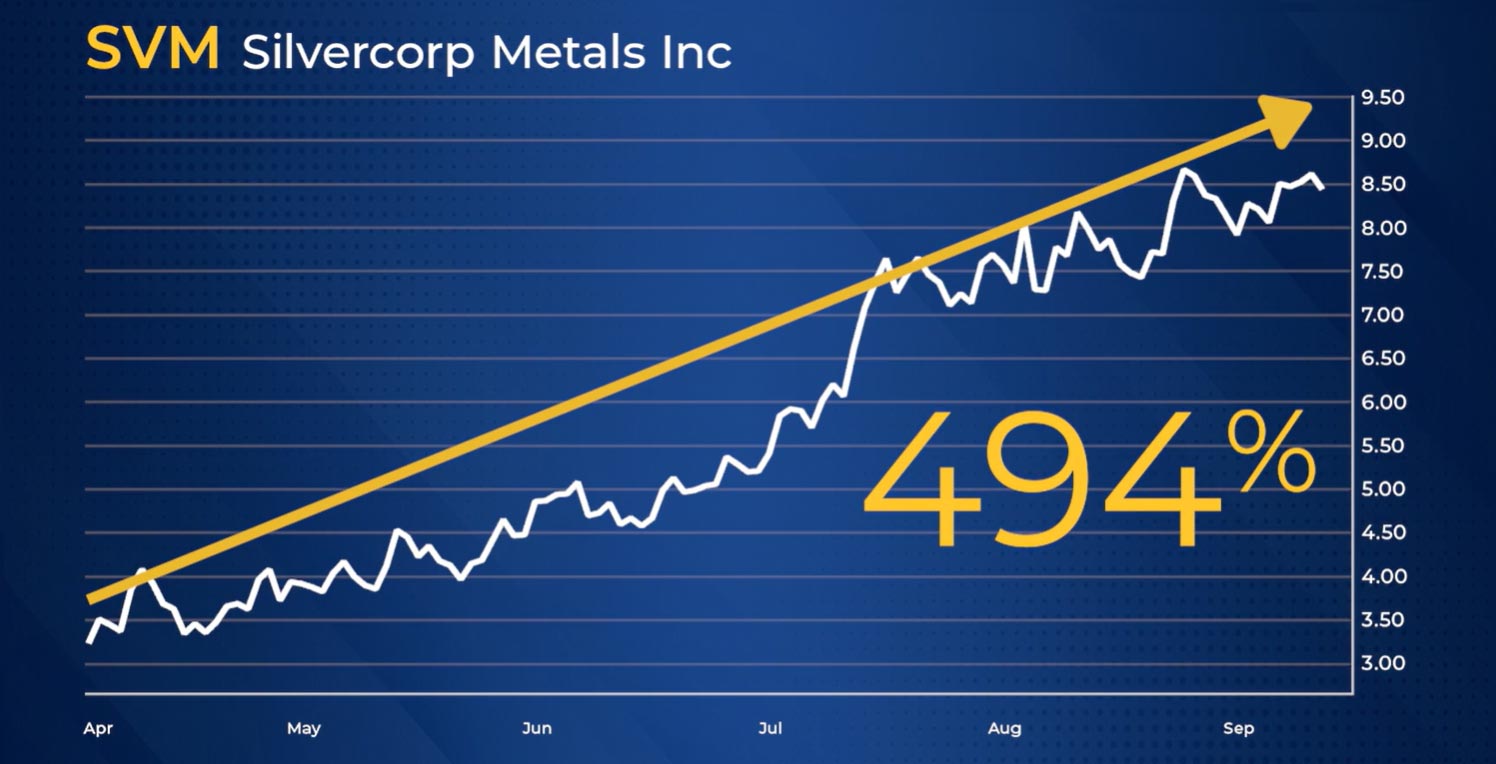

Silver Corp Metals gained 494% in just half a year.

Mag Silver soared an astonishing 530% in just ten months.

That’s 25 times more than physical gold during the short Covid bull run.

CHRIS: That’s definitely something investors would be interested in.

And now, Sean, you believe we are reaching this stage of the market again?

SEAN: Yes!

The Silver Cross has appeared.

It happened on July 22nd.

Now …

All those above are exceptional examples of what’s happened before.

And you can never truly predict what will go on in any market.

So you should never invest more than you are willing to lose.

But …

As crazy as this may sound …

This Golden Paradox has a new element …

That has more experts than just me salivating.

CHRIS: Okay, you’ve got my attention.

What is this research telling you?

SEAN: Instead of telling you, let me show you.

Take a look at this chart.

For the past decade, silver miners have been bumping into a ceiling.

With those enormous rallies being snuffed out before they could really take off.

But in September, unmistakable signals flashed that this downtrend was over.

Experts are saying it’s the end of a nine-year winter for silver mining stocks.

When you combine this with the Silver Cross of silver passing gold …

Silver miners aren’t just coming out of the wilderness …

They are preparing to lead the next phase of the cycle.

Many analysts believe silver mining stocks could triple in value compared to silver …

Just in just the next 12 to 24 months.

CHRIS: Wait, I need to clear something up.

Because you showed us some pretty big gains for some miners during COVID.

But you are saying that they weren’t even hitting their full potential at that point?

SEAN: Yep, they were being snuffed before they could really take off.

Now that the nine year winter is coming to an end …

This next run is going to be powerful.

CHRIS: Wow, that sounds great Sean.

But I still have one big question …

How do we know which of these mining stocks are gems and which ones are just plain old rocks?

Why Many Mining Stocks

Are a Waste of Your Time

SEAN:I’m glad you asked, Chris.

Because it’s imperative to differentiate between a good miner and a bad one.

I’ve seen just about every silver stock under the sun.

And I have to be honest — many of them are not worth your time.

A lot of mining CEOs are slick-talking salesmen, first and foremost.

They’re full of hype and empty promises.

As an investor, you want to run from these stock promoters as fast as you can.

CHRIS: Alright, that makes a lot of sense and is not surprising.

But how do you separate the wheat from the chaff here?

SEAN: It’s why I swear on boots-on-the-ground research.

It’s practically impossible to do it from behind a computer screen.

You have to visit the mines …

Interview the geologists and CEOs …

And then verify everything through rigorous follow-up research.

That’s what I’ve been doing over the past 3 decades.

I’ve visited mines as far north as Nunavut, Newfoundland and Alaska.

And as far south as Mexico, Chile and Argentina.

In fact, some of the mines I’ve visited are so remote …

I was surrounded by more penguins than I was people.

CHRIS: That’s pretty amazing, Sean.

I’m sure you’ve racked up some serious frequent flier miles.

So, when you visit these mines …

Is there a specific tool or assessment you use to determine their quality?

SEAN: Absolutely.

Specifically, I run every mining company through my G.O.L.D. checklist.

I came up with it over the years to help me scrutinize these stocks.

If an opportunity fails to clear even one of the four points on the checklist …

I cross it off the list right away.

CHRIS: I think I’ve heard about this.

That’s an easy to remember acronym.

I assume because this is a tool to analyze mining companies, it applies to silver as well?

SEAN: You assumed correctly.

Because any company that’s mining precious metals needs to pass this checklist.

CHRIS: Can you quickly walk us through it?

SEAN: Absolutely.

So the first letter on the checklist — the G — stands for geography.

Simply put, I want a project that’s in a business-friendly location.

CHRIS: Ok. And is there anything in particular you’re looking for here?

SEAN: There’s a lot of different factors that come into play.

But in a nutshell, you want to stick to places where good companies can thrive.

Without being used as a piggy bank by grabby politicians …

Or risk of ending up in the middle of some tribal conflict.

While avoiding the crosshairs of non-governmental agencies …

The ones that seem to exist only to make life difficult for businesses.

CHRIS: That’s pretty straightforward. So, what does the O stand for?

SEAN: O is for ore quality.

This is where things get a bit more technical.

And it’s where my decades of experience in this industry come in handy.

Because you can’t do this from your home office thousands of miles away.

You have to personally visit the mine.

Inspect the rock.

Even put on a helmet and go down into the mine pit with the miners.

That’s the only way to get a sense for the quality of a mining project.

A good yardstick for that is what’s known in mining circles as “grade.”

Grade is the amount of silver in the ore.

And it’s measured by grams per ton.

In other words, how many grams of silver there are in a ton of ore.

CHRIS: And just to be clear, the higher the grade, the better?

SEAN: That’s exactly right, Chris.

The average grade at these mines can vary wildly.

From as low as 19 grams per ton …

To as high as 578 grams per ton.

Heck, some go even higher than that.

That’s why it is imperative to do the due diligence to find the best projects.

CHRIS: Understood. After ore quality, we have the letter “L.” What does that stand for?

SEAN: That would be leadership.

As you probably know, Chris …

Management is critical for the success of any business.

And silver mining is no exception.

In fact, I'll even say that solid leadership is more important …

Then the resources the company is sitting on.

CHRIS: There’s a lot more to this than I thought.

All this time, I thought the quality of what came out of the ground was all that mattered.

SEAN: Well, don’t get me wrong.

The silver in the ground is still critical to the success of the business.

But it’s the management that makes it all happen.

For example, folks who have hit it big in mining before are more likely to do it again.

Not only do they have a good understanding of what it takes to succeed …

Because they’ve hit paydirt in the past …

It’s much easier for them to get financing from banks and investment funds.

As an investor, you want to be betting on these grizzled veterans.

Not some slick-talking salesman.

CHRIS: That makes perfect sense.

So that leaves us with one more point on your checklist …

SEAN: Correct. The D, which stands for discovery.

Here, I look for something known among insiders as “blue sky.”

CHRIS: What’s “blue sky?”

SEAN: It's a term we use to describe the size of the resource.

If a resource extends on all sides, it's open like the sky.

And blue sky means untapped opportunities or growth potential.

To give you a practical example …

I’ve been tracking a tiny silver company that’s set to more than double their operations.

From 220,000 ounces of silver today to 500,000.

CHRIS: Wow! That’s a lot of new money for the company.

Especially with silver prices on a tear like they are.

SEAN: Exactly!

At current prices, we’re talking about $750 million in extra revenue.

That’s what I mean by “blue sky” opportunities.

I’m looking for up-and-coming companies with plenty of runway for growth.

Because ultimately, that’s what can send a stock on a wild run.

CHRIS: Ok, let’s talk about that, Sean.

What are the best silver opportunities right now?

Where do you see the biggest upside potential?

SEAN: There are five silver miners that I’m very excited about.

All of them have multi-bagger potential.

And I think they deserve a place in every precious metal investor’s portfolio.

Five Silver Mining Picks Ready to Beat Gold

CHRIS: That sounds great Sean.

I’m sure everyone is excited to get that information.

But before we do that …

Can you tell us more why these particular companies are poised for a huge surge?

SEAN: Of course I can, Chris.

Look, when it comes to predicting gold and silver stocks …

I always try to under promise and over deliver.

But with so many tailwinds pushing silver towards the stratosphere …

Even being conservative …

It’s hard not to envision that the right companies in this sector are going to take off.

CHRIS: What do you mean, Sean?

What are some of these tailwinds you are talking about?

SEAN: Well of course we’ve already talked about the Golden Paradox …

And the Silver Cross has already happened in this market.

But there’s something else that’s pushing silver much higher.

Because …

Unlike gold …

Silver is proving to be more than just a safe haven in times of crisis.

It’s becoming the backbone of the technologies that are shaping our future.

Crucial to multiple different industries.

From medicine, energy and healthcare …

To electronics, telecommunications and the automotive sector.

It’s even integral to the water we drink.

However …

Nothing is pushing silver’s ceiling higher …

Then the AI boom.

Everything from data centers and quantum computing …

To robotics and semiconductors.

They all NEED silver to succeed.

CHRIS: What about silver is it that makes it so important?

SEAN: Not just important, Chris.

Irreplaceable.

Silver is the most electrically conductive metal known to man.

Because of this, nothing tops silver when it comes to the important tasks new tech needs.

Things like power distribution …

Data transmission …

Temperature management …

You name it.

It’s why it’s indispensable to so many industries.

CHRIS: Okay, that makes sense.

And that must be driving demand up big time.

SEAN: That’s an understatement, Chris.

Demand for silver reached 1.25 billion ounces in 2023.

And last year 59% of that demand came from industrial applications.

With silver being so important to the race for technological superiority …

It’s no surprise that for the first time in more than 20 years …

Major central banks worldwide are pushing to make it a part of their central reserves.

CHRIS: That seems like a pretty big deal.

SEAN: It’s huge.

Especially when you consider who’s leading the charge.

CHRIS: And that is?

SEAN: The two leading economies in the world …

The United States and China.

China is racing to acquire as much of it as they can to get ahead of the west.

And just recently …

The U.S. classified it as a critical mineral.

Moving it from being a simple inflationary hedge …

To a strategic national security asset.

CHRIS: That’s pretty serious stuff, Sean.

And I can only assume that’s pushing the demand higher?

SEAN: Let me put it to you this way, Chris.

If central banks allocated a mere 1% of their current reserves to silver …

It would represent over 1/5th of annual global production.

CHRIS: That seems like a high number for just a 1% allocation.

SEAN: It’s enormous.

And would only further strain a supply that can’t keep up.

The same year that demand for silver hit over 1.25 billion ounces …

Silver production was just 2/3 of that.

CHRIS: That’s a pretty significant gap.

So I’m sensing a theme here, Sean.

Demand is through the roof …

Supply can’t keep up …

Therefore, you believe silver is just going to continue to shoot for the moon?

SEAN: Exactly, Chris.

I think silver is going to hit $100 very soon.

That would mean an already $3 trillion market could double in the very near future.

Especially as this gap between supply and demand continues to grow.

Thus …

The companies that can help close this gulf quickest …

Will see the biggest growth.

CHRIS: And you’ve led us full circle here, Sean.

I’m going to go out on a limb here …

And guess that these five picks are geared up for production?

SEAN: You guessed correctly, Chris.

For example …

One is already sitting on 371 million ounces of silver equivalent in resources.

That doesn’t even include another project that sets to launch in 2028 …

Which could add millions more to this stockpile.

In fact …

Even without it, production still jumped 20% last year.

I truly believe this company’s stock price is going to take off very soon.

CHRIS: Again, a result any investor would love to see in their portfolio.

SEAN: Absolutely.

But my research says it’s not the only high quality silver miner ready to break out.

Another I’ve zoned in on …

Is the leading producer for the area of the world with the highest demand for silver …

Asia.

Another has 12 mines in seven different countries …

With a 13th in the pipeline.

They produced over 5 million ounces of silver in the second quarter of this year alone.

All at a fixed rate per ounce that is less than a third of silver’s current price.

CHRIS: Yes, I recall you mentioning that these well-established miners have fixed costs.

SEAN: Good memory, Chris.

To put it simply … this company is producing a LOT of silver …

And making two times more on each ounce …

Then what it costs to pull it from the ground.

CHRIS:Well, that’s a pretty good way to drive up their share price.

Okay Sean, how can everyone at home get access to these picks?

SEAN: I’ve put everything together in a special report called …

Ride The Silver Bull:5 Stocks to Beat Gold.

It has all the detailed analysis you need on each of these five different opportunities.

Including a way to buy a stake in dozens of high quality silver miners …

In one simple investment.

Not only is it already up more than 100% this year …

You can earn extra income simply by owning it.

CHRIS: A way to earn bonus cash on your investments, who doesn’t love that?

SEAN: I thought you might like that, Chris.

And I think you’re going to like what I have to say next even more.

CHRIS: I’m all ears.

SEAN: As you said earlier …

We are beginning one of the largest silver bull markets in recorded history.

That’s why before I tell you exactly how to score this silver report …

I feel compelled to share a few more stocks that I think have massive potential.

And this may surprise you …

But they are gold related.

The Beneficiaries of Gold’s

Potential Rise to $7000 …

CHRIS: It doesn’t surprise me, Sean.

I know you’ve said you believe gold is going to touch $7,000.

SEAN: That’s right, Chris.

Which means I think gold is going to nearly double its current price.

And just like with silver …

The biggest production costs for gold miners happen at the beginning.

That means even a 20% gain in gold’s price …

Could mean multiples for the miners.

Especially for the ones with strong deposits.

CHRIS: What do you mean when you say strong deposits, Sean?

SEAN: Well, Chris …

The supply side of gold is having its own crisis.

Even as prices break records …

Exploration spending on finding new gold has been cut in half the last decade.

Fewer discoveries mean less supply in the future.

CHRIS: I don’t think I need an economics degree to know what that means, Sean.

Gold prices are just going to keep rising.

And the ones who can provide the supply to meet the demand are best positioned?

SEAN: Exactly.

My research has unearthed a few absolute diamonds in the rough.

For instance …

I’ve found one that is going to produce over a half million ounces of gold …

With the production costs at their largest mine being less than $1,000 an ounce.

CHRIS: Hold on a second …

Just doing some quick math tells me they are making more than $3,000 per ounce?

That’s incredible.

SEAN: It really is, especially when combined with their high production numbers.

But they are just one of the supply stars in this market.

There’s another whose highly efficient business model …

Puts their estimated costs per ounce at nearly $300 …

Without moving an inch of dirt.

CHRIS: Okay, this sounds like yet another amazing opportunity.

How can viewers get their hands on this list?

SEAN: It’s all there in a detailed report called …

5 Essential Gold Stocks for the Bull Market

Inside you’ll get everything you need to know about the best ways to play this market.

Including two bonus picks …

AND …

A way to get exposure to multiple miners at once …

While earning income to invest in them.

On top of that …

I want to share an extra report.

It’s my Guide to Buying Physical Silver and Gold.

Now I believe silver and gold miners are the best bang for your buck in this bull market.

But …

With the economic chaos that’s happening all around us …

It’s still imperative for investors to own some physical silver and gold.

My guide will reveal all the ins and outs of the best ways to do it.

Including:

- The best places to store your gold and silver

- How to avoid scammers and fly by night operations

- The specific coins to buy…and the ones to avoid

- And how buying silver from before 1965 could get you a discount

CHRIS: This sounds like a great way to block out the noise …

And acquire the best gold and silver to protect your wealth.

SEAN: That’s exactly right, Chris.

I’m prepared to rush it to your inbox …

Along with Ride the Silver Bull: 5 Stocks to Beat Gold …

And 5 Essential Gold Stocks For This Bull Market

Right away.

I only ask for one small favor in return.

Give my monthly newsletter, Wealth Megatrends, a risk-free try.

Multiple Big Wins

Since Gold’s Last Bull Run …

CHRIS:

Tell us a little bit more about Wealth Megatrends, Sean.

SEAN:

Well, HOST, I am a cycles expert.

Understanding cycles …

Like the Golden Paradox …

Is how I’ve been able to call the top and bottom of every gold bull market for 20 plus years.

Because it’s these big shifts in the cycle …

Where fortunes are won and lost.

In Wealth Megatrends, my team and I will guide you through these cycles.

On the third Friday of each month, you’ll get the latest issue.

Where I share at least one new recommendation.

What my research says is the best way to play the current moment in the cycle.

And because trends and cycles are constantly shifting …

You’ll always be the first to know via instant alert if I see a big move coming …

In either direction.

CHRIS: With the volatility of the market as it is, that’s a reassuring thought for investors.

SEAN: That’s the goal, Chris.

To provide our subscribers with the most accurate and up to date information.

That’s why I insist on doing the boots on the ground research.

Like travelling to some of the most remote places on the planet …

Or poring over geological reports and financial statements …

And interviewing executives and CEOs to get the real story.

It’s this in-depth analysis that’s allowed me to nail some big-time winners.

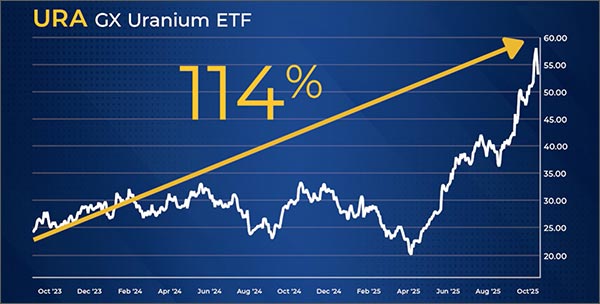

Like 114% on a uranium ETF in two years.

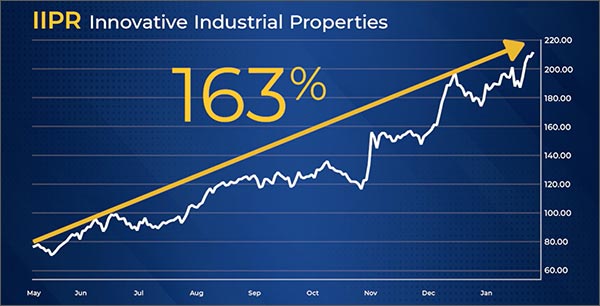

Or 163% on Innovative Industrial Properties in just nine months.

Even 194% on GE Vernova in just seven months.

In fact, in this last gold run.

I’ve given my subscribers 10 different chances of gains of 50% or higher …

Four of them a shot at doubling their money.

Since that last gold bull run, my average gain is 54% …

And that includes the losers.

CHRIS: That’s quite impressive, Sean.

SEAN: That’s not all, Chris.

When you join us at Wealth Megatrends …

You get an extra layer of protection for your investments.

The backing of our powerful Weiss Ratings System.

The Number One Stock Rating System

in the World

A study in The Wall Street Journal ranked Weiss Ratings #1 for profit performance …

Ahead of many of the biggest names in finance.

Including Deutsche Bank …

Merrill Lynch …

Morgan Stanley …

JPMorgan Chase …

Goldman Sachs …

Standard and Poor’s …

And every other financial firm they reviewed.

When the US Securities and Exchange Commission (SEC) …

The New York Stock Exchange …

And attorney generals of many states commissioned a study …

To determine which financial ratings company had the best profit track record for stocks.

Weiss Ratings didn’t just come up in the top 10 …

The top five …

Or the top three …

They were number ONE - overall!

The reason is simple.

Weiss Ratings is a completely independent, truly unbiased ratings company.

We never accept a dime from the companies or issuers we rate.

Never have …

Never will.

Since we started this business nearly 55 years ago …

Our goal has been to give regular Americans the critical information they need …

To not only keep up with Wall Street …

But to beat it.

We have a history of finding exceptional gems in the market …

Long before others.

In the last two decades plus …

Weiss Ratings has issued “Buy” Ratings to nearly 14,000 different stocks.

The average gain is 305% …

And that’s including the losers.

Our proprietary ratings system is based on 100 years’ worth of stock market formulas…

Backed by over 7 terabytes of data.

Since we launched it in 2003 …

Our buy recommendations have yielded enormous opportunities for investors.

Those who got in at the right time had 2,903 opportunities to double their money …

338 chances to make ten times their investment …

Even an incredible 27 different chances to make 100x gains.

The best part is …

All the investments we make in Wealth Megatrends are backed by these ratings.

It’s one of the many benefits you get when you subscribe.

CHRIS: Wow, when you shine a light on those types of gains …

It’s no wonder the Weiss Ratings system is the best in the world for turning a profit.

Okay, folks, just to recap for you right now.

When you join us at Wealth Megatrends, here’s everything you’ll receive.

- 12 Monthly Issues. On the third Friday of every month, you’ll get a new issue full of Sean’s latest research on the biggest megatrends, along with a fresh recommendation for the next hot way to play the current cycle.

- ASAP Alerts and Updates. Any time the market swings or something changes with one of his recommendations, you’ll be the first to know. He’ll send critical alerts to stay ahead of the market.

- Full Access to the entire Wealth Megatrends catalog. You’ll be privy to any and every issue, alert and special report we’ve published on a number of different topics.

- Free subscription to Weiss Ratings Daily. Keep up with the everyday movements of the overall market with our expert analysis. All our analysts contribute to deliver the latest news and updates from around the financial world.

On top of that, I’ll send you two valuable special reports right away.

- Report # 1: Ride The Silver Bull: 5 Silver Stocks To Beat Gold. There comes a point in every gold bull market where silver takes off and leaves gold in the dust. That Golden Cross moment has occurred … with momentum pushing silver towards record highs for the foreseeable future. History has shown that investors could have made up to 469 times more than physical gold.

- Report #2: 5 Essential Gold Stocks For the Bull Market. Gold still has a long way to climb, potentially as high as $7,000. And the best way to turbocharge your gains on gold is through these specific companies who are positioned to soar as gold goes up. Previous winners include 77% on Wheaton Precious Metals and 81% on Alamos Gold and Ashanti Gold Limited

- Report # 3: Guide to Buying Physical Gold and Silver. As a general rule of thumb, it’s always important to maintain a healthy supply of physical gold and silver. Especially in the chaotic economic world we live in today. In this report, you’ll learn the best ways to both protect and enhance your holdings. The best types of physical gold to buy – and which scams to avoid.

Sean, this all sounds great.

How much does it cost to join Wealth Megatrends?

Less Than a Tank of Gas …

SEAN: Thank you, Chris.

One year of Wealth Megatrends normally retails for $129.

And that’s what thousands of our subscribers pay.

But with the next phase of the golden bull market underway …

And silver beginning its ascendancy …

This could be your last chance to take advantage of an incredible opportunity.

One that historically has given investors a chance to score huge gains …

Quite often even better than buying gold itself.

So I want to make you a special offer …

You will get a full year of access to everything I just mentioned.

For just $49.

That's 62% off the suggested retail price.

And a meager $4 a month.

In fact a one year subscription …

Costs less than a tank of gas.

I think you'll agree it's more than fair.

And if at any point during your first year, you are unhappy with your subscription …

Just call our U.S. based member care team.

And they'll be happy to give you a full refund …

Right up to the very last day of your membership.

You can keep every issue, every bonus report, and every alert you've received.

As a special thank you for giving Wealth Megatrendsa try.

But as a show of good faith for taking a chance today …

There’s one other megatrend developing that is too good not to share.

CHRIS: What’s that Sean?

SEAN: It’s the budding relationship between the U.S. government and critical minerals companies.

You see …

As important as silver is to this international race for technological superiority …

There are a handful of other rare metals that are paramount to winning as well.

Honestly …

China’s dominance of these critical materials has been their biggest trump card …

During these tit for tat tariff negotiations.

It’s why the U.S. government is racing to creating their own supply.

Spending billions in the process.

Even JP Morgan has committed more than a trillion dollars to the effort.

CHRIS: Sounds like both a cause for concern … and an opportunity.

SEAN: It is indeed both, Chris.

And it’s where my decades of experience in mining comes in handy.

Upon further investigation …

I’ve discovered three unique companies that I believe will rise more than others.

As a result of this trillion-dollar investment.

One is the sole producer of antimony in the United States …

Which has become a huge focus for the Department of Defense.

Another just received an $80 million grant from the government …

And supplies 70% of the country’s copper …

Long an economic success indicator but a newly named critical mineral.

The third company just inked a contract with the Pentagon and Lockheed Martin.

With the goal to supply niobium and scandium.

Two crucial metals to aerospace, defense and the automotive sector …

And they are currently 100% imported by the United States.

CHRIS: Sounds like there is a lot of potential for these companies to solve a huge problem.

SEAN: There really is, Chris.

That’s why this is a massive opportunity in an untapped market.

And as a bonus for cost conscious investors …

Two of these emerging companies are trading for well under $10 a share.

But I don’t expect that to be the case for long.

I’ll share everything you need to know in a special report …

Mission Critical: The 3 Companies the Government Is Counting on to Take Down China

CHRIS: That is more than generous, Sean.

Especially considering all the critical information you’ve shared with us in this presentation.

Now …

I know you are super busy and are probably set to jet off to another far away location.

Is there anything else you’d like to share before we let you go?

SEAN: Yes, I do, Chris.

While gold has been red hot, we are entering the next phase of this market.

The Silver Cross has appeared, and silver is ready to take its turn in the spotlight.

And when you consider the importance of the white metal …

As well as the growing gap between supply and demand …

My research is telling me right now is the best time to get in on these high-quality silver miners …

Before they potentially take off and the chance for these great gains are gone.

I hope you’ll join us on this journey.

CHRIS: Well put Sean.

Folks, just as a reminder of all the benefits you will receive …

When you join the tens of thousands of subscribers at Wealth Megatrends.

- BENEFIT #1. A full 12 months of access to Wealth Megatrends

- BENEFIT #2. Ride the Silver Bull: 5 Stocks To Beat Gold

- BENEFIT #3. 5 Essential Gold Stocks for This Bull Market

- BENEFIT #4. Guide to Buying Physical Silver and Gold

- BENEFIT #5. Mission Critical: The 3 Companies the U.S. is Counting On To Take Down China

- BENEFIT #6. One year of access to our 53,000 Weiss Ratings, including not only stocks but also ETFs, mutual funds, and other sectors.

- BENEFIT #7. My flash alerts for critical, time-sensitive opportunities and warnings.

- BENEFIT # 8. Free access to Weiss Ratings Daily

- BENEFIT #9. My Unconditional 365-day 100% Money-Back Guarantee

- BENEFIT #10. Huge savings!

All for just $49.

A steep discounted rate …

And a mere 13 cents a day.

I think you'll agree it's more than fair.

Even so …

If you are dissatisfied with your subscription.

Just call our U.S. based member care team …

And they'll be happy to give you a full refund …

Right up to the very last day of your membership.

Though I think you’ll be highly satisfied …

And prepared to solve the Golden Paradox …

Thanks to the dozens of opportunities Sean is ready to share with you.

The Silver Cross has arrived.

Silver is making its move.

This could be the last chance to take advantage of a situation that has historically yielded incredible results …

Don’t wait.

Click the button below to join Wealth Megatrends right away.