America’s No. 1 stock ratings system called every major financial event of the 21st century. Now it’s signaling …

AI’s Second Wind

If you missed out on the 3x, 5x, or even 10x gains of the past year, this could be your best chance to latch onto one of the greatest booms in history.

INSIDE: We’ll share the name and ticker symbol of 3 little-known AI stocks ready to surge in 2025. Every time our system flashed green like this, the average gain has been 303%.

Hi, my name is Tom Mustin …

And I have an important message for all American investors …

We are living in unprecedented times.

With AI stocks soaring to record highs in the past few years …

Most people think it’s too late to get into AI right now …

That the biggest profits are already off the table.

But nothing could be further from the truth …

The AI frenzy has already minted around 500,000 new millionaires in the US alone …

And it’s just getting started.

AI is about to catch its Second Wind … and potentially explode into the greatest boom we’ve ever seen.

That’s according to the #1 stock rating system in America …

Weiss Ratings.

While some of the current AI top dogs are getting crushed right now …

This eerily accurate system is flashing green on a new set of stocks …

All of which could become the biggest winners of 2025 and beyond …

Thanks to a massive event that could trigger rapid surges in the share price of a certain type of company.

Specifically, Weiss Ratings identified 3 under-the-radar picks that have signaled to thrive in the next stage of the AI boom …

With the potential to outperform the AI winners of the last couple of years.

In a moment, we’ll reveal the names and ticker symbols of these 3 potentially explosive stocks …

Right here, live in this video …

For FREE.

If you’ve been thinking about staying on the sidelines because you’re late to the AI party …

Think again …

The AI boom is only getting started.

And AI stocks are about to get their Second Wind.

For those who missed out on the recent windfall …

This could be the best chance to latch onto one of the greatest booms in history …

And potentially grow a nest egg throughout retirement …

So please stay tuned …

Because in a moment we’ll share what our Weiss Ratings says are the best opportunities of 2025.

But this isn’t the first time Weiss Ratings is ahead of the crowd …

Signaling substantial wins that could be just around the corner …

Just like it happened for some of its most exceptional picks …

The Most Accurate Stock Ratings System in The World

Case in point …

Many consider Warren Buffett to be the greatest investor of all time …

But Buffett didn’t see the profit potential of Apple …

Until it was patently obvious the company was a jackpot.

Buffett bought Apple in 2016.

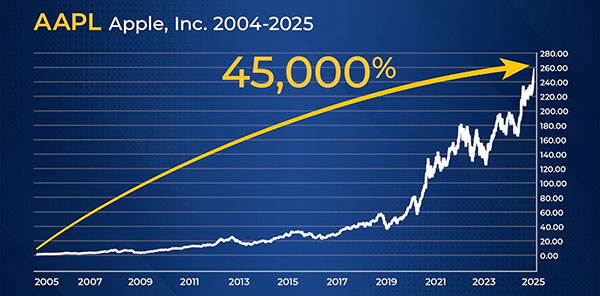

On the other hand, Weiss Ratings pinpointed Apple way back in September 2004 …

That’s 3 years before the iPhone revolutionized the way we interact with the world …

By the time Buffett’s company, Berkshire Hathaway, finally began accumulating a stake in Apple in 2016 …

Apple’s shares already gained 4,800% from the date Weiss Ratings labeled them a Buy.

In fact, all this time Weiss Ratings never downgraded Apple to a Sell …

Even during the financial crash of 2008 — when everybody and their dog were screaming to get out of the stock …

Weiss Ratings kept Apple as a Buy.

And investors lucky enough to have access to Weiss Ratings … and put a modest sum of $10,000 into Apple at that time …

They would’ve been sitting on close to a half a million dollars before Buffett even thought about getting in.

Apple is up over 45,000% today.

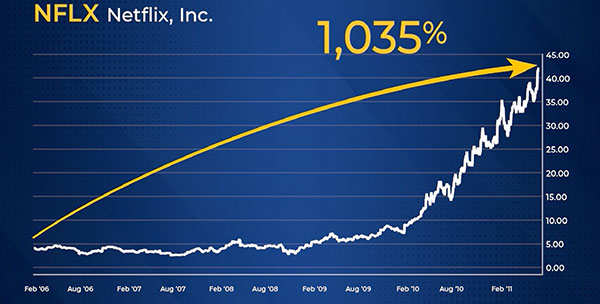

A similar thing happened with Netflix …

Weiss Ratings issued a Buy in January 2006.

Back then, Netflix was in the business of online DVD rentals …

The internet was still in its infancy …

And streaming movies over the web was as good as science fiction.

Most people didn’t think much of Netflix because they couldn’t see the potential …

In fact, analysts at JP Morgan downgraded the stock because in their view …

And I’m quoting here …

“[Netflix] faces competition from Blockbuster that is much tougher than we had originally expected.” — JP Morgan, 2007

We all know what happened next …

By July 2011, Netflix had shot up 1,035% …

That’s more than 10x in just 5 years.

The stock is up over 27,000% today.

Talk about seeing into the future …

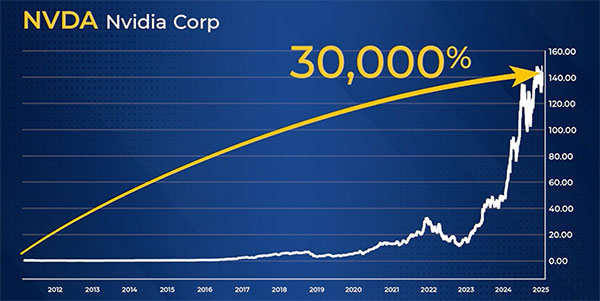

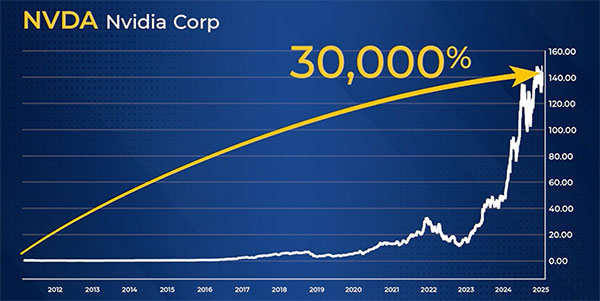

In 2011, Weiss Ratings also identified a little-known company, Nvidia, as a must-have in everyone’s portfolio …

That’s more than a decade before AI stocks captured all the headlines …

Since then, Nvidia is up almost 30,000%.

And investors who followed Weiss Ratings … and put a small stake of $5,000 into Nvidia at the time of the Buy rating.

Could be sitting on nearly $1.5 million today.

In fact, Weiss Ratings has issued a Buy alert on over 12,000 different stocks over the last 22 years.

The average gain across all Buy stocks is 303%.

That includes the losers.

Which means every time Weiss rated a stock a Buy … investors had a solid chance of making three times their money or more.

And best of all …

Weiss Ratings is a completely FREE tool.

Anyone can use it to help guide their investments.

In a moment, we’re going to show you how Weiss Ratings works …

How to access it …

And how you can use it to take advantage of AI’s Second Wind …

In fact, we’ll go so far as to release the critical details on 3 little-known stocks that could surge in the coming months …

Totally FREE.

So stay tuned for that in just a moment …

But there’s one thing I want to mention upfront …

To my knowledge, what you’re about to see is the most advanced stock picking system I’ve ever come across …

It’s powered by similar technology used by Nvidia, Goldman Sachs and some of the world’s top performing hedge funds …

Every day, Weiss Ratings combs through 15,000 publicly traded stocks …

Processing 4,300 data points on each of them — daily …

Using proprietary indicators that nobody in the world has …

To make sense of all of this data, the system runs 1.2 billion calculations every single day …

And then it determines if a stock is a Buy, a Hold, or a Sell.

No human could ever do anything like this …

But despite having hundreds of thousands of data points and some very advanced technology behind it …

Weiss Ratings is very simple for the every day person to use.

You don’t have to be a rocket scientist …

You don’t even need to have much experience when it comes to investing …

All you need is an internet connection …

And you're ready to go …

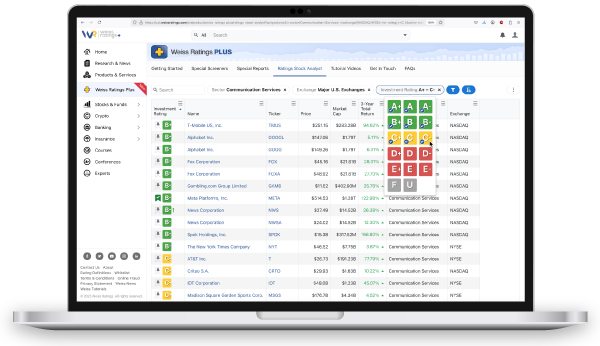

Because ultimately, what Weiss Ratings does — it ranks stocks with five grades …

Just like children used to get in elementary school.

A, B, C, D or E.

Anything better than a C is considered a BUY. Anything below C is a SELL.

But don’t let this simplicity fool you …

Weiss Ratings’ uncanny ability to find the right stocks before anyone else …

Has earned them the title as America’s #1 stock rating system from established entities in the financial world …

Like the Wall Street Journal:

In fact, according to the Journal, investors using Weiss Ratings could’ve made more money than investors who followed the ratings from …

Deutsche Bank … Merrill Lynch … JPMorgan Chase … Goldman Sachs … Standard and Poor’s … and every single other firm they reviewed.

And when the US Securities and Exchange Commission (SEC) conducted an internal study to determine which financial ratings company had the best profit track record for stocks …

Weiss Ratings didn’t just come up in the top 10 … the top 5 … or the top 3 …

They were number ONE — overall!

But let me show you how easy it is to use Weiss Ratings …

So you can see for yourself … from some of the best performers over the years:

Take a company like Unilens Vision (UVIC) …

Weiss Ratings upgraded the stock to B- in July 2003 …

Meaning, it was now a Buy.

Which was surprising because there wasn’t much news about the stock at the time.

People were still licking their wounds from the recent market crash …

And most were reluctant to pour their money back into the stock market …

But look at what happened soon after Weiss Ratings marked UVIC a Buy …

Sure enough, over the next three months the stock climbed 175% …

And went on to gain a staggering 12,753% one year later.

Investors who followed Weiss Ratings … and put a small sum of $10,000 into UVIC when the system marked it a Buy …

Could have made over $1.25 million in just one year.

But it gets better …

By the time Weiss Ratings changed its grade to a Sell, UVIC was up more than 265,900% …

That’s enough to turn that same $10,000 into a whopping $26 million!

Wow!

And as incredible as it may sound — this is not just one lucky guess …

As you're going to see, the same pattern repeats over and over:

Weiss Ratings pinpoints a stock …

Upgrades it to a Buy …

And many times the stock moved up steeply soon after.

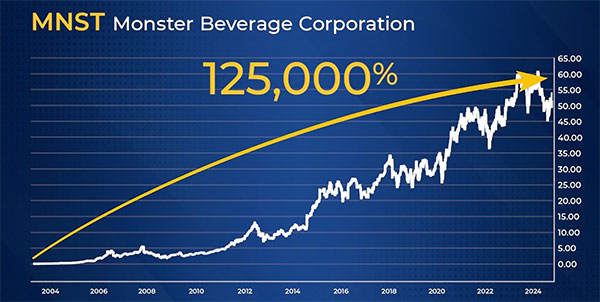

Let's look at another example — Monster Beverage Corp …

Weiss Ratings upgraded the company to B- on April 2, 2003 …

It was now considered a Buy.

And over the next 12 months, the stock hiked 253% …

It’s up over 125,000% since …

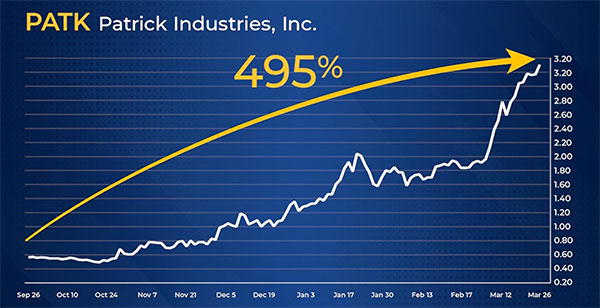

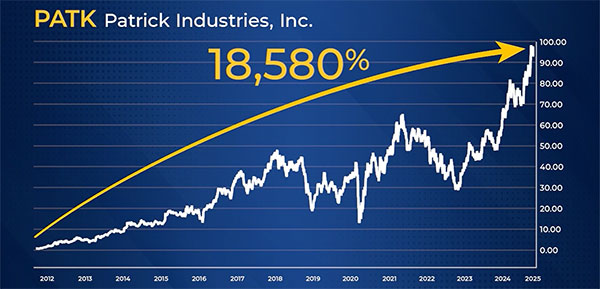

Similarly, Patrick Industries went up 495% in 6 months after Weiss Ratings issued a Buy in September of 2011 …

And it’s been up more than 18,580% since.

Here are some more …

Weiss Ratings issued a Buy on BOX.U on April 2003 …

Twelve months later, it hiked 1,093% …

And by the time it went private in July 2017, it was up 12,864%.

And Copart gained 10,668% — all after Weiss Ratings upgraded it to a Buy in April of 2003.

But what's even more astonishing …

Weiss Ratings' powers expand far beyond the stock market …

You see, thanks to the colossal amount of independent financial data the system has access to …

Together with advanced algorithms and proprietary indicators analyzing that data 24/7 …

Weiss Ratings is also able to issue extremely accurate ratings on banks … insurance companies … and even cryptocurrencies.

In fact, Weiss Ratings is one of the very few systems that correctly called nearly every major financial event of the 21st century:

It predicted the bank failures of the 1980s …

The dot-com bust of the early 2000s …

And the market recovery that followed …

The Great Financial Crisis of 2008 …

And the market crash of 2020 …

On top of that …

Weiss Ratings pinpointed 98% of the banks that failed during the 2008 financial crisis — months in advance …

All the while, Wall Street big wigs and DC elites were swearing on a stack of Bibles that everything was fine …

But people who followed Weiss Ratings would’ve had a chance to keep their retirement savings and investments intact …

And maybe even profit along the way …

Because throughout the years, Weiss Ratings has managed to stay one step ahead of the curve.

In the 1980s, they were the first to fully digitize their massive stock research database …

Today, that system contains over 7 terabytes of solid financial data …

As far as we know that’s more than any other comparable ratings system in the world.

They were also among the first to use artificial intelligence to enhance the performance of its algorithms …

Long before AI tools like ChatGPT became mainstream …

In fact, more than $25 million dollars went into its development …

Effectively creating one of the most advanced stock ratings systems in the world …

Which is completely free to the public …

With the best investment performance of any publicly-known trading system available today …

And yes …

That includes bull AND bear markets …

Because Weiss Ratings is always ahead of the crowd …

Like 1999, for example:

It was at the height of the dot-com bubble …

The Nasdaq more than doubled in all that frenzy …

Analysts at big firms like Morgan Stanley … Bloomberg … or JP Morgan …

Kept issuing optimistic reports with hugely inflated valuations …

And Zack’s — a famed stock ratings company — couldn’t find a single stock on the Nasdaq ranked a “SELL”.

Investors kept piling in …

But Weiss Ratings signaled something completely different:

It said 90% of all those stocks were radioactive!

Sure enough, the Nasdaq fell 75% a few months later …

And people who followed Weiss Ratings could have avoided the bloodbath.

Then, at the beginning of 2003, something changed.

Weiss Ratings started to flash a new signal.

In the wake of the tech bubble collapsing in early 2000s …

Its grades started soaring for a special group of technology companies.

Like NetEase, Inc …

One of the firms who got caught up in the tech bubble.

Most had left them for dead …

The stock was trading for around 60 cents on April 2, 2003 …

When suddenly, Weiss Ratings upgraded them to a Buy.

Just six months later, the stock almost tripled. It went up 284% …

And it’s up more than 12,900% today.

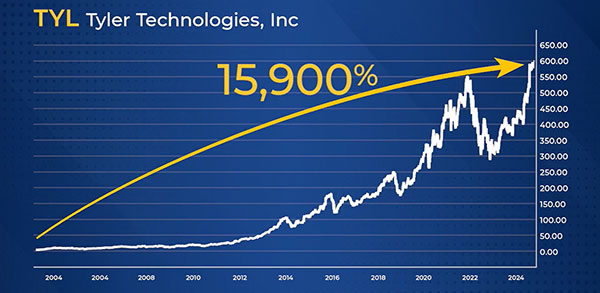

Tyler Technologies was in a similar situation. Its share price fell more than 85% during the dot-com bust …

And even if the stock gained a little bit of steam in the months following the crash …

For the next couple of years, it was mostly going sideways.

But then, surprisingly to the average market observer, Weiss Ratings raised its grade — and made TYL a Buy in April 2003.

Sure enough, over the next year the stock hiked 168% …

Now, it’s up over 15,900% today …

And investors who followed Weiss Ratings … and had put a $10,000 stake into Tyler Technologies …

Could be sitting on nearly $1.6 million today.

And when you consider what happened with Ebix — another software company relegated to the scrap heap of tech failures …

You’ll notice the same pattern repeats once again.

Weiss Ratings issued a Buy on Ebix on April 2, 2003 …

The stock shot up 453% in the 12 months that followed …

That’s more than 5x in just one year …

And between 2003 and 2019 it went on to gain over 13,120%.

Now, to put that into perspective …

During that same time period, the S&P 500 gained only 249% …

But Weiss Ratings hasn’t just been accurate when it comes to predicting which stocks are going up …

It also has had an uncanny success rate on red flagging stocks headed for a fall.

For example …

At the end of September in 2019, Weiss Ratings downgraded Fobi AI (FOBI), a software and data intelligence company to E– …

Meaning, the stock was now a strong Sell …

Most investors were probably scratching their heads. After all, tech stocks were booming back in 2019, remember?

But to everyone’s surprise, just six short months later, FOBI fell off a cliff. It went down 59% … and it’s still down 80% today.

The same happened with Avix Technologies (AVIX) — one of the hot companies during the 2000 dot-com mania …

Regular investors didn’t see it coming. But it turns out, the firm was nothing more than a flash in the pan …

Because six months after Weiss Ratings downgraded it to a D.

The stock plummeted a whopping 98% … and never recovered afterwards.

And more recently, during the COVID pandemic, when all the pharma stocks were flying high …

Weiss Ratings suddenly downgraded NRx Pharmaceuticals (NRXP) to a Sell …

Most investors probably ignored it, lured by the profits of similar picks like Moderna, Novavax and so on …

But sure enough, six months later, the stock plunged 76% …

And it’s down 99% today.

Weiss Ratings often sees things that other systems don’t see …

And that human analysts couldn’t even fathom.

It’s all because of the valuable real-time stock market data fed into Weiss’s servers.

On top of that, they are completely independent.

They’re not influenced by the businesses themselves. And they don't accept a dollar from advertisers …

Weiss Ratings relies exclusively on unbiased data they collected over decades …

That’s a big reason why, in the past 20 years, Weiss Ratings has never had a losing year on the stocks they upgraded to a Buy.

In other words …

If investors had tuned out all the hype … all the emotions … and just followed what Weiss Ratings was signaling to them …

For the past 20 years, they would have made on average 303% for each and every signal.

Which brings us to today …

Weiss Ratings is flashing green again …

AI is about to catch its Second Wind …

Thanks to a massive event that could send a specific set of stocks skyrocketing …

And investors who get in position ahead of time — before it’s too late …

Could witness some of the greatest wins of our lifetime.

In a moment, we’re going to show you how Weiss Ratings works …

We’ll walk you through — step by step — how to use it to tap into AI’s Second Wind …

And we’ll share the name and ticker symbols of the 3 highest Buy-rated AI stocks on our list right now.

Our data suggests these little-known stocks could surge in the coming months …

And I know this sounds like a bold claim …

And you might be skeptical …

But here’s the thing …

As incredible as these past AI gains have been …

We could see even bigger moves in the next 12 months …

Why do I say that?

Because Weiss Ratings’ impeccable track record has proven itself over and over and over again …

In any market condition.

In fact, the system’s unusual ability to find stock movements ahead of time …

Goes as far back as one hundred years — where it all started …

Back to …

The Roaring Twenties.

Like today, it was a time of massive technological growth.

Even just a few years before, people were roaming around with horses and buggies …

Suddenly, everybody had a car.

Airplanes …

Boats …

Railroads …

All of that became available to the masses …

And many Americans traveled the world for the very first time.

Most importantly, everyone seemed to be making money.

The New York Stock Exchange was rapidly expanding …

The Dow Jones Industrial Average (DJIA) was just introduced …

And every company in America was rushing to get its name listed.

Investors were tripping over each other to buy any stock they could lay their hands on …

Even shoeshine boys at the steps of the NY Stock Exchange were giving out stock tips.

Everyone got sucked into the buying frenzy …

Pouring money into stocks like there’s no tomorrow …

But not for a young stockbroker named Irving.

Irving was skeptical.

He had just started to work on Wall Street …

And the euphoria he observed in the financial world didn’t match the harsh reality in his own neighborhood in Harlem.

Something was off — and he was determined to find out what was going on.

And so, while people were dancing and clinking drinks …

Irving spent nearly every waking hour at the New York Public Library …

Poring over financial reports of America’s largest companies …

Tracking the data and taking notes.

And what he saw in that data — as clear as day — confirmed his suspicions …

America wasn’t just due for a stock market crash …

The country was about to face one of the biggest financial disasters in history …

And there was not much time left to prepare.

Irving rushed to warn everyone to stay away from the stock market … to get the heck out.

But all the veteran brokers in his office laughed at him.

“Is young Irving trying to hurt our business?” they said …

But Irving trusted the data.

He borrowed $500 from friends and family and shorted the market.

He advised others to do the same …

Except for a few loyal clients, people ignored him.

And then, the unthinkable happened.

Black Monday, Oct. 28, 1929.

The Dow crashed almost 13%. And the very next day, on Black Tuesday, it tumbled another 12%.

In today’s market, that would be like the Dow crashing 5,000 points in just 48 hours.

But it got worse.

In the months that followed, top to bottom, the average stock lost about 90% of its value.

Many Americans saw their entire life savings wiped out …

But a small group of investors who listened to Irving’s warnings …

And did exactly what he suggested …

They were able to not only avoid a grave disaster … but also make a lot of money.

Irving himself made a fortune …

But he didn’t stop there.

He kept collecting and analyzing the data …

And soon after, he saw another major event coming.

It was the end of 1931, near the bottom of the market.

And this time, Irving told people it’s time to buy.

Investors were skeptical. Many wouldn’t listen, still licking their wounds from the recent crash …

But the data Irving was looking at was clear …

And in the months that followed, from June 1932 to August 1933 …

The market hiked more than 150%, regaining a big chunk of its losses.

Again, Irving was right …

And people who followed his advice made a fortune.

The word about Irving’s uncanny accuracy spread like wildfire …

And he went on to build a successful career, rubbing shoulders with some of the biggest names on Wall Street …

The Irving in this story …

Is none other than Irving Weiss.

The data he collected … and the formulas he created almost a century ago …

Were the genesis for Weiss Ratings — America’s #1 stock ratings system we’re going to share with you today …

But it wasn’t until 1971, when his son Martin Weiss joined the company …

That Weiss Ratings finally started to take its modern form … and became the technological marvel that it is today.

You see, for years, Irving kept his data on handwritten spreadsheets and stacked them in folders in his library.

But Martin believed the future was in digital technology …

And took things even further …

He hired world class analysts and software engineers to update and bolster Irving’s proprietary formulas.

They digitized every single piece of stock market data applied to this system.

Over 100 years worth.

More than 7 terabytes of data.

That’s enough to store nearly 1,500,000 songs …

If you listen to 10 hours of new music daily, 7 terabytes would last you for over 32 years.

Now that data powers Weiss Ratings.

And with the recent addition of AI, the technology is far ahead of the rest of the market.

Today, Weiss Ratings is flashing green again …

AI is about to catch its Second Wind and it could trigger a mad rush into a new set of stocks …

Who could become the biggest winners of 2025 and beyond.

And like I mentioned, our system identified 3 under-the-radar picks that could thrive in the next stage of AI boom …

We’ll provide all the details about which ones in just a moment …

Because if investors take a position right now in the right picks …

This could be the best chance to tap into one of the greatest booms we’ve ever seen …

With the potential to skyrocket their retirement …

But don’t expect to hear this kind of information in the mainstream media …

The talking heads on TV are often late to the party …

And that’s why many regular investors keep missing out.

Just look at what happened during the first AI boom recently …

People rushed into Nvidia only after ChatGPT exploded into the mainstream …

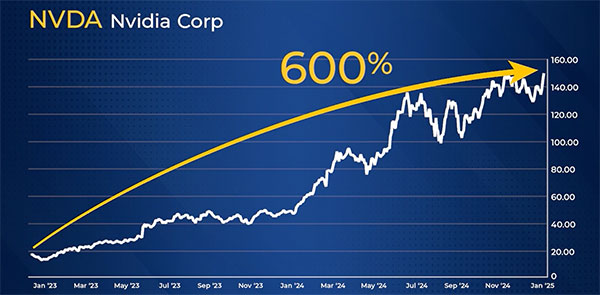

That stock is up almost 600% since December 2022 …

Turning every $5,000 into almost $35,000 …

Which is not too shabby.

But let me remind you, Weiss Ratings pinpointed this AI super stock way back in 2011, when you could get it for a fraction of its current price …

Since then, Nvidia is up almost 30,000% …

And because Weiss Ratings NEVER told you to sell it …

Meaning, it never downgraded Nvidia to C- or below …

That’s enough to turn $5,000 into nearly $1,500,000.

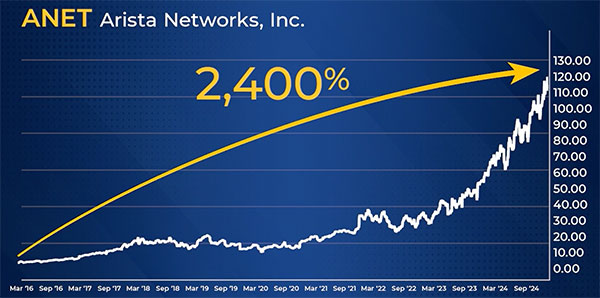

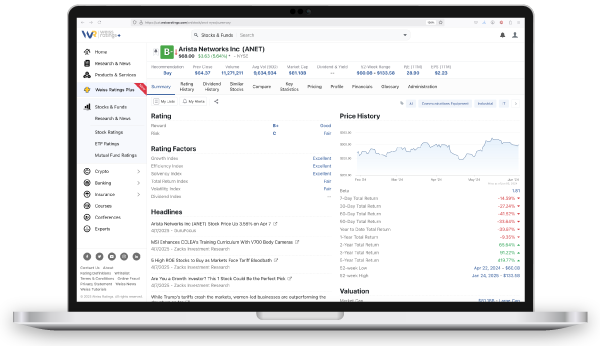

Similarly, Arista Networks — another top performer during the recent AI boom …

Made 310% in the last 2 years.

But Weiss Ratings marked it a Buy way back in 2016 …

It’s recently been up almost 2,400% since.

That’s almost an 8x difference in profits just by following Weiss Ratings’ signal …

In the case of Trimble — its share price rose as much as 998% since it was rated a buy in January of 2004 …

AMD jumped 159% from February 2020 to May 2024 …

And ServiceNow recently hiked over 156% since July of 2020 …

… all after Weiss Ratings rated them a Buy …

Which was months — and sometimes even years — before AI was even mentioned in the mainstream media.

How is that possible?

Because to my knowledge …

Weiss Ratings may be the only system on Earth that seems to have the ability to “see” around the corner …

Thanks to its access to one of the biggest financial dataset in the world — a whopping 7 terabytes of it …

With a proprietary state-of-the-art technology analyzing this mountain of data 24/7 …

Running 1.2 billion calculations — daily.

Right now, Weiss Ratings is signaling that AI’s biggest boom yet is poised to take off …

And a new set of companies’ shares could start soaring very soon.

Like I mentioned, the system has identified the 3 best stocks to own during AI's Second Wind …

With the potential to uncover the next AI superstars.

In a moment, we’re going to list these 3 companies, free of charge.

Anyone who likes what they see can go out and buy them right now, knowing they are Buy-rated by Weiss Ratings …

Obviously, nothing is guaranteed in the market. You shouldn’t invest more than you can afford to lose. And past performance does not guarantee future results.

At the same time, Weiss Ratings was ranked #1 by both the SEC — the authority that regulates the stock market — and the Wall Street Journal, the world’s foremost stock market publication.

Over 20 years, stocks rated Buy by Weiss have made an average of 303% …

Including the losers.

So you’ll want to get out a pen and pad, and write down the names of the stocks we’re about to give you.

But, before I do that …

I want to share a secret with you …

Something very few people know about our Weiss Ratings …

The free stock market grades are just the beginning …

In other words, while the basic stock ratings are freely available to the public …

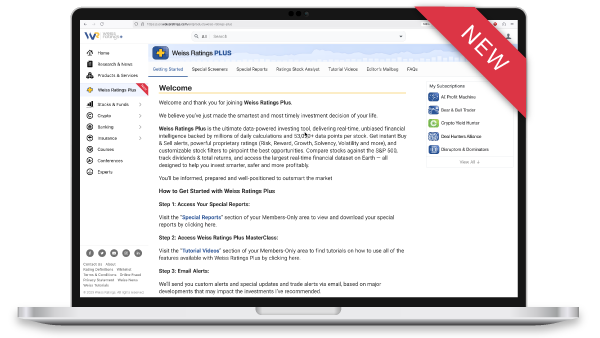

There’s a whole other level to Weiss Ratings — a secret portal full of powerful investing tools you can use.

This advanced level of Weiss Ratings is built for independent, self-directed investors …

Who are fed up with Wall Street tilting the table against regular folks at every turn …

Who don’t trust clueless brokers and money-grabbing financial advisors …

This advanced tool is built for people who want access to only the best, unbiased real-time financial data to give them a chance to supercharge their returns …

As you’ve seen today, Weiss Ratings has been able to anticipate big stock moves ahead of time. With the average gain on each and every Buy of 303%.

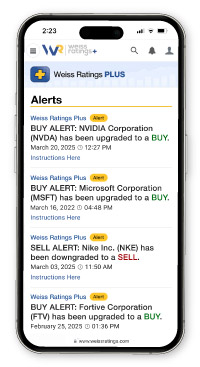

Keep in mind, through this secret portal, you can get an alert every time Weiss Ratings upgrades a stock to a Buy …

On top of that, you can get notified immediately after Weiss Ratings downgrades a stock to a Sell …

So those following can avoid losing money before it’s too late.

Like I said, while everyone can go and look up the basic stock grades for free …

These instant Buy and Sell alerts are just some of the many advanced features locked away from the general public …

And only accessible through this secret Weiss portal.

We have never opened this portal to anyone before …

But today, we’d like to give you a chance to try it out.

You see, there’s a reason you’re watching this special broadcast right now …

Not everyone understands the importance of investing in the right stocks …

Especially in the times like we live in right now — where things are changing at warp speed before our very eyes …

That’s why, we want to offer you a special invitation …

And give you access to this critical investment tool — the advanced level of Weiss Ratings …

To my knowledge, this is the best way to help investors stay ahead of the markets …

And help them navigate their way through all market conditions …

Because here’s the thing …

Weiss Ratings doesn’t just rate tech stocks …

It rates every single stock on the market — all 15,000 of them.

Its proprietary ratings model performs 1.2 billion calculations every day — just to make sense of all that information.

Each company is evaluated using historical data spanning decades …

That’s why, Weiss Ratings has been able to find winning opportunities in EVERY sector …

Technology … retail … energy … financials … real estate … commodities … you name it …

And often before these companies hit the mainstream headlines.

This fact alone can be a huge advantage for anyone who invests in the stock market …

Like I said, through this secret portal, Weiss Ratings will send you an immediate alert the moment any stock is upgraded to a Buy — automatically …

Last year, 272 firms were upgraded to Buys.

That’s nearly one new pick folks can add to their portfolio every day …

Obviously, whether you buy the stock is up to you …

But Weiss Ratings will let you know the moment it finds the next great investment opportunity …

You’ll be one of the first to hear about it.

So let me ask you …

How much time do you spend researching all these companies … before you decide to invest in a specific stock?

Well, if you’re anything like me, I don't trust the talking heads on TV …

Which means I can waste days, weeks, or months glued to my computer screen … and I still have no clue what I’m supposed to do.

I missed out on so many opportunities because I couldn’t make any sense of it all.

But with Weiss Ratings, you can save time and headaches … and just let the system do all the heavy lifting for you …

In fact, you don’t even have to know what a company does to be able to profit from it …

Case in point: Aehr Test Systems, Inc …

I’m betting most people have never heard of this company. I know I hadn’t …

But 12 months after Weiss Ratings upgraded the stock to a Buy in August 2022 …

AEHR was up 209% …

The same happened with Badger Infrastructure Solutions (BDGI) …

I have to confess, I hadn’t heard about this firm either.

But a quick search showed me the company deals with soil excavation services …

I'm still not even sure I know what that means.

But once Weiss Ratings upgraded it to a Buy in 2003 …

The stock skyrocketed 891% in just 12 months.

Or BioSyent (RX) — who hiked 672% in one year after Weiss Ratings upgraded it to a Buy in 2011 …

And MTY Food Group (MTY) — up 524% in one year as well …

… all after Weiss Ratings graded them a Buy in 2003 …

These are some of the exceptional winners that our system has pinpointed over the years

And the average gain of each and every pick is 303% — including the losers.

Lets face it, most people can only find a winning stock AFTER the fact … once it hits the newswire.

But Weiss Ratings has provided investors a chance to profit from future winners in every industry …

And often long before everyone else catches on …

But this is just a small sample of all the powerful features that are only accessible through this secret Weiss portal I told you about …

We call it Weiss Ratings Plus.

And today, we’re making Weiss Ratings Plus available to you.

Stay tuned to find out how to take advantage of this special invitation to use Weiss Ratings Plus.

We’ll cover all the details in a moment — there’s a huge benefit for you …

Because like I said, what you’ve seen so far is just scratching the surface of what Weiss Ratings Plus can do for our investment portfolios.

I’ll share more details about it in a moment …

But I must mention …

A comparable system, the Bloomberg Terminal …

Is regarded as one of the most advanced tools available to financial professionals …

It costs over $25,000 a year just to have it sit on your desk.

Normally, you’d find these machines in the corner offices on Wall Street …

All big hedge funds are using them …

But even a Bloomberg Terminal doesn’t compete with Weiss Ratings Plus when it comes to accuracy and profitability for investors.

Weiss Ratings was ranked #1 by both the SEC and the Wall Street Journal …

It’s powered by similar technology used by Nvidia and Goldman Sachs …

And over the past 22 years, the average gain across each and every Buy graded stock is 303%.

Can any of the big Wall Street investment banks or hedge funds brag about similar achievements?

I don't think so.

Which reminds me …

Everyone watching right now, get ready and go find a pen and a piece of paper …

Because in just a moment, we’re going to share the names and ticker symbols of top 3 stocks that we believe will thrive during AI’s Second Wind …

Weiss Ratings is flashing green on these picks right now …

We think they could start going up fast.

And could become the biggest winners in 2025 and beyond.

But first …

What is causing AI’s Second Wind?

And why does Weiss Ratings show these new set of stocks are ready to push forward?

Two reasons …

First of all, when it comes to the economy and the stock market, it really matters who’s in the White House.

Right now, America has THE most pro-business, pro-tech and pro-innovation Administration in recent history …

And I’m not just talking about President Trump …

I’m talking about all the high-level tech people he hired as advisors or appointed to critical positions such as David Sacks … Mark Andreessen … just to name a few.

They know the industry.

They’re all boots-on-the-ground …

And are actively involved with AI.

But, more importantly, they know what the industry needs to thrive in 2025 and beyond.

In fact, President Trump just announced a hefty $500 billion-dollar investment for a new AI project called Stargate …

Which will focus on building out data centers and the electricity generation needed for the further development of fast-evolving AI …

And it's all happening right here on American soil — in Texas.

Just imagine what that could do to the stock market and to AI stocks in particular when even more money starts pouring in …

Which brings me to my second point — the most important of all …

Slashing regulations and cutting taxes.

President Trump just signed an Executive Order called "Unleashing Prosperity Through Deregulation” …

As the name suggests its aim is to cut unnecessary regulations.

You don’t have to be a genius to know that cutting red tape help the economy …

And as a consequence, innovation — especially in AI — could skyrocket at warp speed.

Add to that Trump’s plan to lower the corporate income tax rate to 15 percent …

Add it all up and we believe it’s only a matter of time before the stock market explodes to new all-time highs.

Now, some people seem to think China could pose a threat to America’s AI dominance …

Especially with the latest release of its ChatGPT killer, DeepSeek AI …

But nothing could be further from the truth.

In fact, legendary Silicon Valley tech investor, Marc Andreessen believes this competition is a good thing …

Because it’s like our “AI’s Sputnik moment” …

Remember what happened soon after the Soviet Union beat the U.S. into space in 1957 … with the launch of the first satellite (Sputnik) into orbit?

It was a blessing in disguise …

Because it ignited America’s drive to dominate all rivals.

Sure enough, after that "defeat" …

We created NASA and put the first man on the moon …

We also created the internet … which allowed companies like Google, Apple and Amazon to become the biggest companies in the history of the world …

And that’s just a small list of all the extraordinary technological achievements that unleashed massive economic prosperity.

And I’ll say this …

The profits we could see in the coming months — thanks to what we are predicting will be AI’s Second Wind …

Could dwarf some of the highest AI gains we’ve seen in recent years.

And while the big AI winners like Nvidia or Tesla are getting crushed right now …

There’s a new set of AI stocks that could skyrocket in this second AI boom.

And in just a moment, I’ll show you the names and ticker symbols of the top three of these under-the-radar AI picks …

Weiss Ratings just upgraded them to a Buy …

So we believe this is a good time to consider getting in.

Most people probably never heard of these companies before …

But if history is any guide, they could become the biggest AI winners of 2025 and beyond …

And so, without further ado, let’s reveal the names and ticker symbols of the 3 free picks now …

3 Little-Known AI Stocks Set To Surge in 2025

Okay, here they are. Weiss Ratings just rated them a buy and you’re among the first to learn about them.

So I urge you to write their names down immediately.

Because if history is any guide, it could be just a matter of time before they start to move up.

AI STOCK #1

TechnipFMC, FTI:

An energy technology provider deploying robotics and integrating automation to boost subsea and surface-level operations.

FTI’s Weiss “Buy” recommendation is driven by an “Excellent” Reward Rating and “Good” Risk Rating. FTI has delivered explosive growth in operating profit and revenue and earnings are expected to continue booming in the next two fiscal years.

AI STOCK #2

Garmin, GRMN:

Swiss manufacturer of AI-powered wireless devices including smartwatches and technologies for automotive, marine and aviation applications. Garmin has “Excellent” marks in growth, efficiency and solvency and is just crushing the consumer discretionary sector in profitability, showcasing robust gross margins, operating profit, net income and cash flows.

AI STOCK #3

AMETEK, AME:

Provides AI-enhanced electronic sensors, control devices and testing systems for industrial applications. AME is another profit and cash flow generating machine with operating margins that are twice the sector median. Founded in 1930, Ametek has delivered steady, above-average top and bottom-line growth, which has accelerated in the last quarter.

But here’s the best part …

These are just the first three on the full list of AI stocks.

In total, Weiss Ratings identified — and upgraded to a Buy — TEN under-the-radar AI stocks that could skyrocket …

That’s right, there are seven additional opportunities for investors to consider for AI’s Second Wind.

Unfortunately, we don’t have time here to name them all …

So we did something even better …

We gathered all the names and ticker symbols … and all the details about why we believe these 10 AI picks could become household names in 2025 and beyond …

The three we just mentioned — and the additional seven …

And we put all this valuable information in a special report called, “The Best Way to Play AI’s Second Wind: 10 Stocks to Own For the Next Boom” …

We’re going to share it with everyone watching right now. So stick around till the end to get all the details about how to claim it …

But I need to be clear. Making money is just one half of investing …

The second half — and just as important — is avoiding losing money …

And as I’ve shown you today, Weiss Ratings has been just as accurate at pinpointing which stocks are going to fall.

Even in today’s market, there are many stocks people should absolutely avoid …

We call them portfolio killers …

Because if you happen to have a position in any of them …

It could mean the difference between a successful year and a portfolio killer …

For this reason, we prepared a second special report called, “Sell Alert: 5 Popular Stocks You Should Avoid Like the Plague” …

In it, you’ll find critical details of 5 popular stocks that Weiss Ratings recently ranked a Must-Sell.

Now, these are household names many regular investors keep holding in their portfolios …

Make sure you’re not one of them …

Because according to Weiss Ratings, they’re a ticking time bomb — and you should consider dropping them immediately.

And when Weiss Ratings says it’s time to sell — it can often mean the stock is headed for a nosedive.

We want to share this second report with you today, together with your first report, “The Best Way to Play AI’s Second Wind: 10 Stocks to Own For the Next Boom …”

As part of our special invitation offer for you to try Weiss Ratings Plus.

But before I give you all the details about how to take advantage of our invitation …

Let me tell you a bit more about Weiss Ratings Plus and show you some of its amazing features …

Weiss Ratings Plus Benefit #1:

Instant Buy & Sell Alerts

Now, I already talked about this before …

But getting instant alerts when a stock is upgraded to a Sell — or downgraded to a Buy — is at the core of our system …

I can’t stress enough how critical it is to get into and out of position at precisely the right moment …

Especially when you are trying to grow your investments or minimize your losses.

Sudden shifts in the market happen all the time — it’s a challenge to stay on top of it even for the most sophisticated investors …

And while nobody can time the stock market 100% …

Weiss Ratings Plus alerts are — in my view — as close as it gets …

Here’s why …

I already mentioned that every day, Weiss Ratings combs through 15,000 publicly traded stocks …

It runs 1.2 billion calculations on each of them — daily — using proprietary indicators that nobody in the world has …

And then it determines if a stock is a Buy, a Hold, or a Sell.

Now, here’s the important part …

The very moment a stock jumps to a Buy … or drops to a Sell …

You get an instant notification in your inbox. So you know exactly when and what to do …

Timing is critical in investing.

And you can opt-in to get alerts for as many stocks as you like.

If you so wish, you can set alerts for your whole portfolio — making sure you’re on top of your current investments at all times …

Or, you can start building a new portfolio entirely from scratch, adding a new Buy upgrade every day — or as often as Weiss delivers them to your inbox.

Last year, Weiss Ratings Plus identified over 270 new Buy stocks on average. That’s almost one new pick in your email every single day …

Meaning, you could’ve had at least 270 new opportunities.

Which brings me to …

Weiss Ratings Plus Benefit #2:

Custom Reports

Every single grade that Weiss Ratings Plus issues for a specific stock …

Is based on two key factors: Risk Index, and Reward Index …

Which in turn are composed of several metrics each.

I’m not going to get into complicated technical details but here’s the gist of it:

You want only the best stocks with minimal risk in your portfolio …

And these two key factors are designed to help you achieve that.

Risk Index measures the potential downsides for a specific stock like: Volatility, Solvency and Valuation …

While Reward Index measures the upside potential of a stock like: Growth, Dividends, Returns, and Efficiency.

Our system does the heavy lifting for you …

Because Weiss Ratings Plus analyzes massive amounts of real-time financial data 24/7 …

You can rest assured all your stocks’ scores are always up to date …

All you do is log in to your Weiss Ratings Plus portal … type the name or ticker symbol of any company you want …

And you can immediately see its up-to-date grade …

As well as how it scores on all these key indicators.

But if you want to know more?

Well, you’ll be happy to know you can create custom reports for any stock you want … and drill down even deeper on all of these metrics I just mentioned.

Say, you're looking for top graded stocks that are the best dividend payers …

Or, perhaps you prefer stocks with the most growth potential …

With a few keystrokes, you can create a report that's updated every time there is new data.

Weiss Ratings Plus adapts to your needs.

Weiss Ratings Plus Benefit #3:

Stock Market Insight

But you’re not limited to simple stock metrics lookups …

You can do a lot more than that …

For instance, you can see the Weiss Ratings’ history of every stock on the market — a point in time when its grades have gone up or down according to Weiss Ratings …

This gives you a birds-eye view of the stock's health trend.

Which is as important as technical charts — but way simpler to understand …

And if you’re so inclined, you can compare whole industries and sectors to see which is scoring better right now …

These metrics aren’t based on opinions or some insider’s preferences …

It’s all unbiased, real-time financial data giving you instant stock market insight.

With a click of a button you can screen stocks by any number of data points you can think of …

While our free Weiss Ratings tool allows you to search only by stock name or ticker …

Weiss Ratings Plus allows you to create a number of filters to find exactly the kind of stock you're looking for …

You can filter and sort by market cap, balance sheets, cash flow, income statement, price change, valuation, sector, total returns by timeframe, profitability, management effectiveness … and so on.

Weiss Ratings Plus is packed with so many amazing features we could be here all day just to list them all …

For example:

You can check how a stock compares to the rest of market, such as the S&P 500 or its peers …

You can check if a company is a leader or a laggard of its sector compared to others …

You can create custom lists so you only track stocks you’re interested in …

You can compare a company's valuation to the rest of its sector …

You can lookup a stock's return history …

… and so much more!

All of this is available to you as part of our special invitation offer to try Weiss Ratings Plus today.

This is a powerful, one-of-a-kind investment tool …

Its proprietary formulas and indicators go as far back as 100 years …

Over $24 million went into its development …

Every day it executes 1.2 billion calculations on 15,000 publicly traded stocks …

With one of the largest real-time financial datasets on Earth …

And it’s powered by similar technology used by Nvidia, Goldman Sachs and some of the world’s top performing hedge funds …

A comparable system, something like Bloomberg could cost you tens of thousands of dollars every year.

That’s a lot of money …

But we’re not in the business of selling expensive software to Wall Street Big Wigs …

So we won’t stand for that price.

Weiss Ratings’ primary and only focus is to give a leg up to regular investors …

Ordinary people like you who work hard …

Who deserve to retire …

And who are fed up with the so called “experts” that never seem to get a single thing right …

We made our mission to create the best tool to help you understand what’s going on in the market …

And help you find winning stocks — before they hit the headlines …

I think we succeeded. Weiss Ratings Plus is that tool.

But we won’t have you paying anywhere near $10,000 or $5,000 for it.

Heck, we won’t have you even pay $500.

Instead, we’ve prepared an incredible deal for you …

And it’s available only with this special invitation today …

But before I give you all the details …

Let me reveal one more thing you might like …

You see, Weiss Ratings doesn’t just rate stocks.

It also rates ETFs … banks … insurance companies …

And even cryptocurrencies.

That’s right!

All the Buy and Sell alerts I just told you about …

All the custom reports, search metrics, filters, data insights …

All of that is available for you to use with banks, insurance companies, ETFs, and cryptocurrencies.

And speaking of cryptos …

Weiss Ratings has identified 3 top rated cryptocurrencies with the most potential to skyrocket in 2025 and beyond.

I’m not talking about Bitcoin, Ethereum, Solana … or anything like that.

These are lesser-known coins, with more growth potential than the “Big Three” everyone knows about.

We created another special report with all the details about these coins and where to buy them.

It’s called, “Top Three Cryptos To Own In This Raging Bull Market” …

And we want to rush this report to you, together with the other two reports …

“The Best Way to Play AI’s Second Wind: 10 Stocks to Own For the Next Boom and “Sell Alert: 5 Popular Stocks You Should Avoid Like the Plague” …

All as an added bonus.

So what’s the catch?

All we ask in return is to accept our invitation to try our premium investment tool — Weiss Ratings Plus.

While our free Weiss Ratings is available to the general public …

Weiss Ratings Plus is a new type of product, exclusive to people watching this broadcast right now — you’re one of the first to hear about it …

We have arranged for you a special charter price, as a thank you for taking us up on this invitation.

When you subscribe to Weiss Ratings Plus today, the price for your one-year membership will be slashed down to just $99 …

You heard that right — just $99 for one year.

That’s less than $1 per day to access the world’s most accurate ratings system.

It is a fraction of what all the elite Wall Street fund managers are paying for similar tools …

Except Weiss Ratings Plus is much better:

It was ranked #1 by both the SEC and the Wall Street Journal …

It’s powered by similar technology used by Nvidia and Goldman Sachs …

And over the past 22 years, the average gain of each and every Buy rated stocks is up to 303% — including the losers!

Here’s Everything You Get …

When you join Weiss Ratings Plus today, you get …

Complete and unrestricted access to one-of-a-kind investment tool with one of the largest real-time financial datasets on Earth.

Big hedge funds are paying tens of thousands of dollars for similar systems …

You’ll also get immediate access to your three bonus reports:

- Special report #1: The Best Way to Play AI’s Second Wind: 10 Stocks to Own For the Next Boom (sold separately for $79)

- Special report #2: “Sell Alert: 5 Popular Stocks You Should Avoid Like the Plague” (sold separately for $79)

- Special report #3: “Top Three Cryptos To Own In This Raging Bull Market” (sold separately for $79)

On top of that, you also get access to our video series called, Weiss Ratings Plus Masterclass.

These video tutorials will teach you how to use every single feature available in Weiss Ratings Plus … all of the stuff I talked about today and so much more … so you can get up to speed and start using it like a pro in no time …

All told, that’s a value of $465.

But like I said, today you get access to all of that for just $99.

And here is our promise to you …

As long as you stay with Weiss Ratings Plus, we will NEVER EVER raise your subscription price.

It will stay at $99 forever.

In other words, by joining Weiss Ratings Plus today, you will lock in the lowest price we’ll ever offer — for life.

Of course, if you’re not satisfied, you can cancel any time — no questions asked — and you’ll continue to use the system until your subscription expires …

But when you see how easy Weiss Ratings Plus can help you turbocharge your returns, I’m confident you’re going to stick around for a very long time.

If this sounds like a good deal to you, then please click the button below to get started …

And don’t worry, when you click the button, you’ll get the chance to review all the details of this offer before you sign up.

The time to act is now …

We are living in unprecedented times.

The last AI frenzy has already minted around 500,000 new millionaires in the US alone …

And it’s just getting started.

AI’s Second Wind could explode into one of the greatest booms we’ve ever seen …

And a new breed of AI stocks could become the biggest winners in 2025 and beyond.

Within minutes from now, you could be one of the first — if not THE first — to learn the names and ticker symbols of these new AI rockstars …

But this can only be your reality, when you take action now.

The longer you wait …

The higher the risk for missing out yet again.

You cannot afford to sit on the sidelines anymore …

This AI boom is exploding so fast — you blink and you could miss it.

So click the button below this video to get access to the power of Weiss Ratings Plus, right away.

Not in an hour.

Not in five minutes.

Right now.

Before the next AI stock becomes a Buy.

Thank you for watching.