The mainstream media has gotten it wrong yet again …

What Most Investors are

Missing About Chinese AI

Breakthroughs like DeepSeek have rattled Wall Street and everyday

investors. But Big Tech CEOs are calling this growth trend a “once-in-a-

lifetime opportunity.” And nine under-the-radar AI stocks could benefit.

Dear Reader,

The mainstream media is completely wrong about AI … yet again.

Chinese AI chatbot DeepSeek recently turned the tech world on its head.

And the media jumped to hasty conclusions.

But as usual, there’s one huge thing they missed …

And it could make a crucial difference for many investors.

You see, AI isn’t dead …

It’s alive and kicking.

Because something strange was happening while the so-called experts were breathlessly signing AI’s death warrant …

The top AI companies in the world were announcing RECORD increases in spending — on data centers.

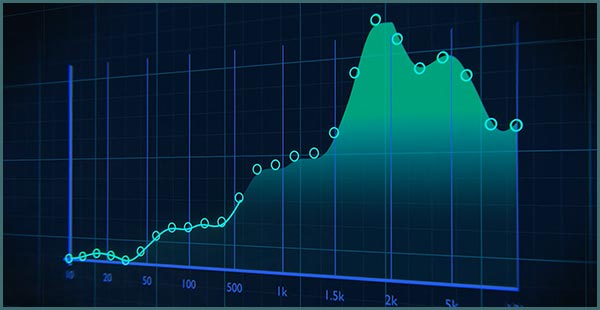

Just look at this graphic.

Amazon pledged $100 billion this year alone.

Meanwhile, Microsoft has committed $80 billion.

Meta and Google have both drastically increased their spending on AI as well.

Amazon CEO Andy Jassy recently declared AI is a “once-in-a-lifetime business opportunity.”

Even after DeepSeek was released.

And Meta CEO Mark Zuckerberg just said 2025 will be a “defining year for AI.”

When it comes to artificial intelligence …

While the mainstream media and Wall Street want everyone to flood the exits …

Big Tech is all-in.

What’s going on here?

Well, it’s simple.

Outside of Big Tech …

Most are missing the point when it comes to DeepSeek.

And investors following all those weak talking heads — like God forbid, Jim Cramer — might unwittingly be making a mistake that could impact their portfolios.

Because here’s the thing …

There was a key detail in DeepSeek’s announcement that nearly everyone missed.

Nvidia CEO Jensen Huang even highlighted it in his most recent earnings call.

Still, it went over people’s heads.

You see, DeepSeek’s release put a glaring spotlight on a massive transformation that’s taking place right now.

But instead of needing less power …

AI is going to need more. Much more.

100x More Power!

Everyone praised the Chinese AI for how cheap it was to develop …

Just $6 million … supposedly … though many experts have cast doubt on those claims.

The media saw the price tag and assumed that because DeepSeek is cheaper …

AI will need far less power going forward.

But those people couldn’t be more wrong.

It will need more power …

100x more.

That’s according to Nvidia’s CEO Huang …

Chip giant AMD’s Chief Executive Lisa Su agreed, saying the need for more power is already “orders of magnitude higher” than just last year.

And it flies against everything the lamestream media talking heads tried to tell you …

That AI is dead. China is taking over. And no more data centers will get built …

This is a massive overreaction that could cost you a fortune in your portfolio — if you’re not careful.

The Economist said, “After DeepSeek, America and the EU are getting AI wrong.”

And Lennart Heim, an AI researcher at RAND said, “I think the market just got it wrong.”

DeepSeek is not going to slam the brakes on the AI buildout …

It’s actually about to shift it into overdrive.

And as soon as the market wakes up and understands this …

It could drive the price of a small handful of AI-focused stocks much higher.

To be clear, I’m not talking about Magnificent 7 stocks or the same tired tech companies.

These companies aren’t even classified as “technology” stocks.

I’m talking about a few totally under-the-radar stocks critical to a nationwide data center explosion that’s only just begun.

Huang said more than $1 trillion will need to be spent on these new data centers over the next few years.

Most of it thanks to four companies: Amazon, Microsoft, Google and Meta.

And that may have been a conservative estimate.

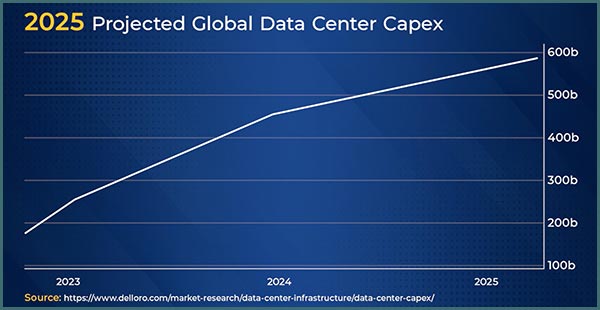

Leading independent market analyst Dell’Oro projects nearly $600 billion to be spent on data centers … this year alone.

That’s because the ones being built right now …

Well, I believe they are in a position to potentially dwarf what came before them.

Thanks to AI’s ravenous hunger for power …

They are beginning to morph into sprawling behemoths.

Let me show you what I mean …

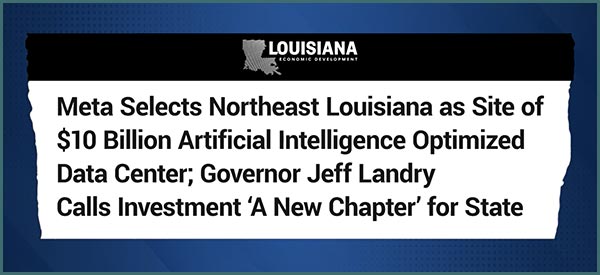

In Northeast Louisiana, Meta has committed $10 billion to a next-gen data center set to occupy more than 4 million square feet.

Mark Zuckerberg said it will be “so large it would cover a significant part of Manhattan.”

That’s Meta’s largest data center ever.

And it’s not the only Big Tech giant building humongous AI fortresses.

There’s also Elon Musk and his xAI supercomputer project, Colossus, in Memphis, Tennessee.

He amazed the tech world when he built it up using 100,000 GPUs in just 122 days.

But Musk was just getting started.

He recently announced an $80 million expansion that will occupy an additional 1 million square feet.

Everything right now pales in comparison to Stargate.

This is a gargantuan, $500 billion endeavor involving Microsoft, Nvidia, OpenAI, Oracle and Softbank, among others.

It was announced at the White House in a press conference with President Trump — just days before Chinese AI rattled the market.

Stargate will eventually feature 20 data centers occupying 10 million square feet.

And get this …

The first site is under construction about 200 miles outside Dallas, and it will be the same size as Central Park.

Softbank CEO Masayoshi Son expects AI to have up to an $18 trillion impact within the next decade.

That’s why Big Tech has gone all in.

As they compete to develop the biggest, most powerful AI models …

These monstrous AI data centers are also rising at a breakneck pace.

More than 130 of these massive complexes are expected to be built every year …

Across the country.

They’re going up in or near major metropolitan cities like Atlanta, Chicago, Seattle, Denver and Phoenix.

As well as untapped areas like Jeffersonville, Indiana …

Rosemont, Minnesota …

Montgomery, Alabama …

Cheyenne, Wyoming …

And Aiken County, South Carolina.

Microsoft spent $1 billion on 315 acres of land in Mount Pleasant, Wisconsin for a new data center.

Amazon is underway on a multi-location buildout in Mississippi with a $10 billion price tag.

Meta is developing an $800 million facility in Kansas City.

Google has a $600 million data center in the works in Lincoln, Nebraska.

The Carolinas, Pennsylvania, the New York Tri-State area, Columbus, Ohio …

Northern Virginia, Silicon Valley …

Coast-to-coast. Everywhere.

Global real estate services company Jones Lang LaSalle likens the current data center buildout to a “modern-day gold rush.”

And even though there are more than 1,000 of them either under construction or in the planning stages right now in the U.S. …

Commercial real estate giant CB Richard Ellis says that the market is still struggling to keep pace with demand.

Nothing has changed since DeepSeek’s debut.

In fact, this explosive expansion is only just beginning …

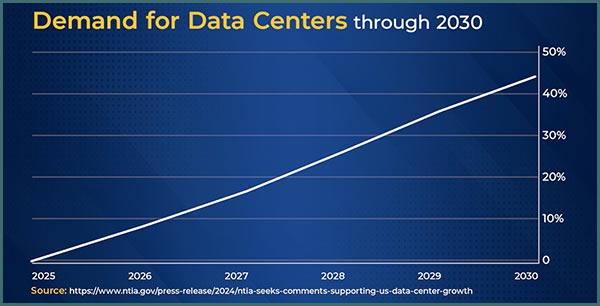

And the market for these super-powered data centers is expected to erupt.

Growth is estimated at 2,000% in the coming years.

And that means hundreds of billions more being spent annually …

Soon to be trillions.

The companies involved with this mass buildout could benefit greatly.

Not just right now …

Not just in the near future …

But through the end of the decade and beyond.

And the AI-focused stocks playing such a pivotal role in this data center explosion could see significant gains.

But these aren’t tech stocks …

They don’t have anything to do with the Magnificent 7, which are vastly overpriced.

I’m talking a limited number of companies capable of providing data centers with a critical resource it desperately needs for this new AI …

Energy.

Stargate is going to need 7.8 GW

You see, there’s one major problem with the skyrocketing data center buildout throughout the country …

One that is projected to grow 9% annually through 2030 …

It’s draining power.

In fact, it’s exhausting grids all over the world.

These are massive, energy-intensive operations that often run 24/7.

And more of them are coming …

Bigger and more powerful, every year.

The projected power demand from AI alone is 7X greater than New York City’s current annual electricity consumption.

In fact, at current growth rates, some new AI servers could soon devour as much as 134 terawatt hours of electricity each year.

That’s more than what countries like Belgium, Switzerland or even the Netherlands use …

In a year.

And it’s only going to get worse.

As much as a quarter of all U.S. electricity could be consumed by AI by 2030.

That’s because these AI fortresses need more power.

Up to 100 times more.

At a recent investor meeting, Dominion Energy CEO Robert Blue said, “economic growth, electrification [and] accelerating data center expansion are driving the most significant demand growth in our company’s history, and they show no signs of abating.”

Remember Meta’s new data center in Northeast Louisiana?

Well, this massive complex will require at least 1,500 megawatts of power.

That’s enough for entire cities like Seattle.

And Musk’s Colossus SuperProject?

Soon, it will utilize up to 3 million Nvidia GPUs.

They are estimated to require nearly 5,000 megawatts.

That’s more than three times the energy used by Meta’s humongous Louisiana data center.

But when it comes to AI data center power usage …

Stargate will trump everything.

By the time it’s completed, it will need 7.8 gigawatts.

That’s the same amount produced by nearly four Hoover Dams!

No wonder Tirias Research forecasts that, by 2028, data center power consumption will be 212 times what it was in 2023.

The world’s existing power supply is being overrun.

And it’s disappearing. Quickly.

These gigantic AI data centers are going to need exponentially more power.

One CEO even said the current demand for electricity in this country has been the largest since the end of WWII.

Tech giants like Sam Altman, Bill Gates and Mark Zuckerberg are desperate to fill the gap.

It’s a dire situation …

But this potential catastrophe could also become one of the most incredible investment opportunities in some time.

Because a handful of stocks are already positioned to help solve this energy crisis.

The Energy Solution Needed Today

Look, this problem can’t wait.

It needs to be resolved right now.

Goldman Sachs says an additional 47 gigawatts of power will be required to support data center growth through 2030.

$50 billion has to be invested in new power generation.

Another $720 billion must be spent on network upgrades.

And these are optimistic estimates.

The grid is tapped out.

Solar and wind won’t work.

They aren’t dependable enough …

And they can’t cover the 24/7 power needs of data centers anyway.

As artificial intelligence continues its explosive growth …

Only one source exists that’s ready to meet increased power demand right now …

Natural Gas.

You see, with the AI data center boom …

The demand for natural gas is projected to soar.

Because it may be one of the only energy sources available today …

Capable of meeting the skyrocketing power needs of data centers.

BP’s CEO Murray Auchincloss said data centers are “driving crazy demand into natural gas” right now.

It’s reliable, it’s cheap, it runs around the clock, and the plants housing it can be built quickly.

Natural gas could prevent costly and catastrophic data center power outages.

That’s why companies are announcing plans for the highest volume of new natural gas-fired capacity in years …

Prominent U.S. natural gas producer EQT Corporation estimates that up to 10 billion cubic feet per day of natural gas will be needed …

Data centers are the biggest reason.

“That’s why people are getting more bullish on gas,” said Wells Fargo’s Roger Read. “Those are some pretty high growth rates for a commodity.”

Existing plants are firing on all cylinders …

And new ones are swiftly being deployed …

Energy data provider Enverus says as many as 80 new gas power plants are expected to be built by 2030.

Enabling data center providers to meet immediate power demands for massive AI workloads.

Some executives stressed the importance of natural gas during recent conference calls.

It’s becoming the “fuel of choice” for the AI data center buildout.

That’s according to Cheniere Energy CEO Jack Fusco.

The mad dash for more natural gas has already begun.

Remember Stargate?

The $500 billion project with 20 data centers occupying 10 million square feet?

It’s going to be powered by a boost from natural gas.

A plant is soon going up on site.

Meta is going the same route.

Entergy, a Fortune 500 energy company, is spending $3.2 billion to deploy three new natural gas power plants at the Northeast Louisiana site.

Utilities and pipeline companies are planning major buildouts of natural gas infrastructure across the country over the next 15 years.

The enormous increase in demand could create some tremendous opportunities …

But there may only be a small handful of companies ready to take advantage of this situation right now.

And the early returns on the stock market have been a nice boost for some of these exceptional examples.

Thanks in part to its deal with Meta …

Entergy has gone up 75% in the past year.

Vistra is one of the largest competitive power generators in the United States.

It’s nearly tripled over the past 12 months …

Comstock Resources, an independent natural gas producer, has gone up as much as 164% over the last year …

Several stocks have already benefited from this emerging natural gas boom …

But bear in mind …

This is just the beginning.

And one company in particular may be uniquely positioned to reap the benefits.

If you’d like to find out more about this stock — I’m calling it AI’s Energy Savior — then stick with me …

Because I’m going to show everyone how to take advantage of the first wave of this natural gas boom in just a few moments.

AI’s Energy Savior

AI’s Energy Savior is a natural gas one-stop shop.

It’s intimately involved in every stage of transmission …

From constructing the turbines, moving natural gas from point to point …

To building the power plants that use it to generate electricity.

Amazon, Chevron, Accenture, Infosys, PricewaterhouseCoopers and a host of other partners depend on this company for their power needs.

And now, thanks to the exponential growth in demand …

There’s a limited supply of gas turbines …

As well as other natural gas-generation equipment.

Although it’s already benefiting greatly from the data center-driven surge in demand …

This particular AI Energy Savior is just getting started.

With an arsenal of expertise tied to this specific sector …

This company is leveraging its natural gas superiority to support the nation’s explosive data center growth.

That includes building a whole suite of new turbines directly powering some of the nation’s largest AI complexes.

Stargate absolutely needs this firm.

Its first data center site requires a $500 million natural gas plant to power it.

And this company will provide many of the necessary turbines.

Then, there’s the site of a former coal plant in Pennsylvania.

It’s set to become the largest natural gas-powered data center in North America.

This $10 billion campus needs seven gas-fired turbines …

Combined, they’ll provide a capacity of more than four gigawatts.

Guess who’s building them?

Chevron, the global gas and oil giant, depends on this company to develop natural-gas power stations for data centers across the country.

Amazon is relying on it to supercharge its data center growth in North America, Europe and Asia.

The Big Tech giant needs this company’s full portfolio of energy products to unlock additional opportunities worldwide.

And it also has the blueprints needed to develop a wealth of power plants throughout the Southeast, Midwest and West regions.

With a stable of products designed to quickly meet global demands …

This is the ideal company for the natural gas boom.

And one that is expertly positioned to help solve the potentially disastrous energy crisis right now.

I’ll share the name, ticker symbol and important buy price info in the special report, AI Energy Saviors.

But wait.

There’s more …

Two additional companies are similarly poised to take advantage of this tremendous opportunity.

Bonus AI Energy Savior No. 1

The first bonus AI Energy Savior has already aggressively carved out a lucrative niche in this market.

It runs the nation’s largest and fastest-growing natural gas pipeline system …

By owning and operating more than 30,000 miles of pipelines …

This company manages approximately one-third of the natural gas supply for the entire country …

Its distribution system stretches from the Northeast down to the Gulf Coast …

But that’s not all.

It’s also a pivotal industry player in the Midwest, Northwest and Mountain West as well …

From Ohio to Salt Lake City, all the way to eastern Washington.

Now, it’s being called upon to support the AI data center network buildout.

That requires it to nearly double its annual CapEx to $2.9 billion …

Most of this additional investment will likely be utilized to expand power generation …

As well as bolstering distribution and transmission.

That’s not all …

It’s also redeploying engineers and project development teams solely to focus on this accelerated demand.

A recently announced $1.6 billion deal is just the start …

It has eight new interstate transmission expansions set for this year alone …

And here’s the kicker …

Many of this AI Energy Savior’s upcoming projects through the end of the decade are tied to data center power generation growth …

That doesn’t even include another 30 potential projects — worth more than $10 billion — currently under development …

With hundreds of AI data centers already sprouting up around the country …

The market for this company’s services could grow considerably.

And it’s not the only one …

Bonus AI Energy Savior No. 2

The second AI energy savior has a narrow focus …

Because it’s going in heavy on the Lone Star State.

Texas is challenging Silicon Valley and Northern Virginia for data center supremacy.

More than 300 of them reside within state lines.

There are 166 in the Dallas-Fort Worth area alone …

With another 49 in the Houston region …

And 44 more in and around San Antonio.

That doesn’t include Stargate, the largest AI infrastructure project in history, which is located in Abilene.

But Texas’s data center boom has created major energy concerns for the state.

As the country’s only independent grid, can it keep up with all the data center power demands on its own?

Right now, it’s all-hands-on-deck.

That’s where this Houston-based company comes in.

It supplies power to multiple states …

But this AI Energy Savior calls Texas home.

It aids customers in the automotive, aerospace, energy and transportation sectors, as well as numerous other industries.

Berkshire Hathaway, Boeing, Ford, Honda, Toyota, United States Steel are among the clients who depend on it.

And now, this company is poised to help keep Texas’ AI surge booming …

Thanks to its mastery of natural gas production.

That’s why its CEO said data center customers are “beating down our doors … they’re going to need our power.”

It has recently signed landmark deals to build several new natural gas plants.

Texas needs its own energy savior.

And this firm has accepted the challenge.

Meaning its stock could benefit greatly from a specific sector of this natural gas boom as well.

All the information needed for these three companies is included in this special briefing, AI Energy Saviors.

I’ll show you how you can claim this exclusive report in a moment.

But first, I want to talk about one of the most successful energy companies in the country.

The No. 1 AI Energy Stock to Own Today

It generates and distributes electricity and natural gas across 16 states …

As well as the District of Columbia.

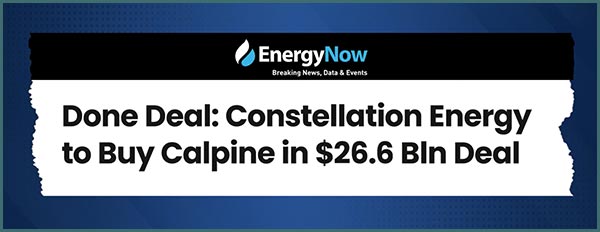

And it recently beefed up its portfolio with a crucial $26.6 billion acquisition.

In doing so, this energy giant gained a large foothold in Texas and California …

Two of the nation’s most electricity-hungry states …

It also expanded heavily along the East Coast.

With a portfolio worth around $29 billion …

And three-quarters of the Fortune 100 companies as customers …

Its natural gas business alone could qualify it as the world’s No. 1 AI energy company.

But here’s the thing …

While natural gas is perfectly positioned today …

There’s actually another power source that benefits more long-term when it comes to this energy crisis.

The AI Nuclear Renaissance

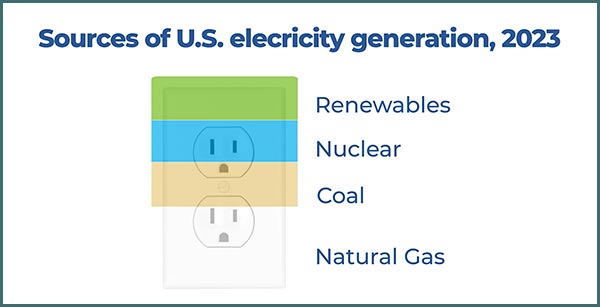

Take a look at this …

It’s a dormant building …

Fallen apart …

Mothballed … left for dead …

Untouched for several years.

Now, it’s being rebuilt … and recommissioned …

Thanks to artificial intelligence.

What is this formerly abandoned building now crucial to AI?

It’s the infamous Three Mile Island nuclear power plant.

What you see is the beginning of a mass revival.

And it’s all thanks to a landmark 20-year deal …

Involving Three Mile Island … Microsoft …

And the world’s No. 1 AI energy company.

Natural gas is the power source that could ease today’s potential crisis …

Because it’s available in mass quantities right now.

But it’s only a temporary bridge …

The best long-term solution …

I’m talking about one that spans decades …

Could lie with nuclear energy.

That’s why Amazon is paying $650 million for a data center to be powered by a similar nuclear plant.

Deals like these are just the beginning …

Since little-to-no new grid infrastructure is needed …

Data centers can be built faster.

That’s why the owners of roughly a third of U.S. nuclear power plants are in talks with tech companies …

Those plants are pivoting to provide electricity to AI data centers …

Right now!

A revolution is sweeping our country.

In fact, Energy Secretary Chris Wright recently said a “nuclear renaissance is just around the corner.”

It could have a massive impact on our electric grid, the future of AI … and the stock market.

The sector, long in the shadows, has been buzzing with excitement lately …

Driven by groundbreaking deals between tech giants and nuclear power providers.

That includes Amazon, Google and Microsoft …

Which have all announced ambitious deals to acquire nuclear energy for their operations.

This power source is attractive because it efficiently provides around-the-clock electricity.

Right now, according to the World Nuclear Association, there are around 440 commercial reactors worldwide …

Including nearly 100 in 28 states here in the U.S.

Over 70 gigawatts of new nuclear capacity are under construction worldwide.

Enough to power every single home in California, Texas and Florida, all at the same time …

With enough left over to power every home in Canada as well.

Rosanne Kinkaid-Smith, the COO of Northern Data Group, said nuclear energy could “power data centers at a very, very high rate of usage for very, very long periods of time.”

Ken Griffin, founder and CEO of Citadel and one of the world’s richest people, said, “nuclear is an important source of … power that our nation needs to meet growing demand for energy.”

And James Walker, a nuclear physicist and co-founder of Nano Nuclear Technology, said, “it’s an unprecedented time in nuclear.”

This new era for nuclear energy is going to require billions in investments by 2030.

And why not?

Big Tech isn’t relying solely on natural gas during this energy crisis …

That's why nuclear stocks are back in fashion right now.

And a small collection of them could soar in the near future.

For some truly exceptional companies, it’s already started.

Lightbridge Corporation is revolutionizing nuclear fuel technology …

Its metallic fuel designs can increase power output in existing reactors.

The company’s stock was recently up 558% in five months.

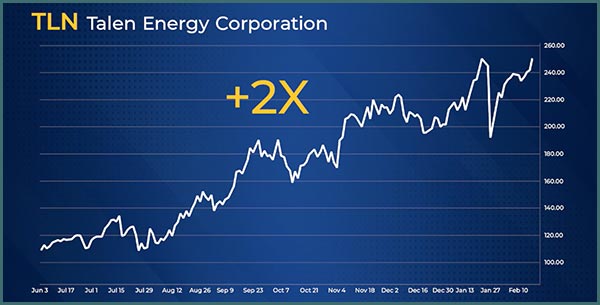

Talen Energy is a power provider who recently sold a data center campus to Amazon in a $650 million deal.

It more than doubled in eight months.

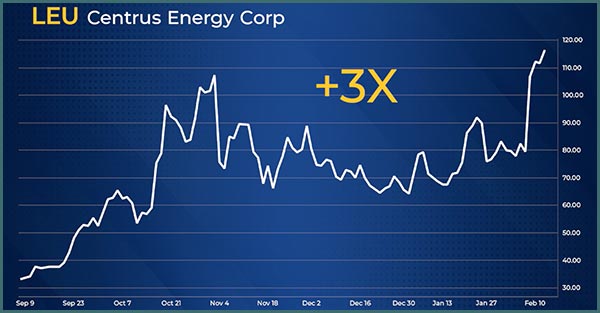

Centrus Energy supplies fuel for nuclear power.

It has more than tripled recently.

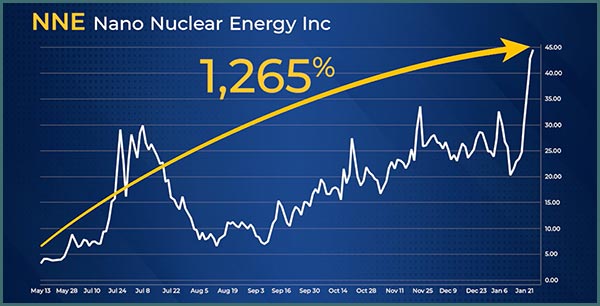

And then there’s Nano Nuclear Energy.

It provides a host of nuclear-related services.

This interest in nuclear energy has already been a boon.

It just surged 1,265% in eight months.

These are extraordinary gains …

But there’s one company uniquely positioned to join their ranks.

You see, the Department of Energy estimates we’ll need to triple our nuclear capacity by 2050.

That means the industry is set to add considerably more volume as soon as possible.

As many as 14 major Wall Street financial institutions …

Including Goldman Sachs, Morgan Stanley and Bank of America …

Have already announced they will support this effort.

This isn’t just a Wall Street phenomenon, either …

Governments around the globe are also heavily investing in a nuclear-powered future.

Including the U.S., which has already made a $1.5 billion commitment to help restart a massive nuclear plant in Michigan.

This nuclear energy run is just getting started …

But here’s the thing …

Only one nuclear reactor has been built in the U.S. over the last 30 years.

Thanks to regulations, it takes a dozen years or more for one to come to fruition.

And although Three Mile Island’s reactor is being revived.

Several others throughout the country still lay dormant.

That means companies with ties to existing operational nuclear power plants have a massive advantage in this boom.

That’s where AI’s No. 1 energy company comes in.

It’s separating itself from the rest of the pack.

Because it can serve as a bridge between natural gas to nuclear energy.

That’s why it’s a titan in the energy industry.

In addition to its immense natural gas portfolio …

It’s also one of the largest nuclear power plant operators — with nearly two dozen — in the United States …

Its established position across multiple energy sources provides the company with a stable foundation …

Consistent revenue streams …

And a wealth of operational expertise.

But it’s never seen a perfect storm of opportunity like this before.

Because with its extensive nuclear infrastructure already in place …

It stands out as a natural partner for tech companies racing to secure reliable power sources for their AI operations.

That’s why it recently signed a monumental contract with Microsoft to restart the nuclear reactor at Three Mile Island.

And here’s the kicker …

It also just completed another energy-related watershed deal.

It’s a $1 billion juggernaut with the federal government.

The largest nuclear-powered contract signed by the United States … ever.

A major component is a 10-year, $840 million deal to supply the government with vast amounts of energy.

Including keeping five existing nuclear plants operating into the next decade …

They are going to power 80 government facilities across six states in the process.

This nuclear energy trend won’t just be another market blip …

It’s part of a larger movement that has far-reaching implications.

Especially as we go deeper into the age of AI.

Nuclear energy is staging a major comeback.

And this company may be poised to benefit.

I’ll send out the name and ticker symbol for this stock as well …

And show how and when to take a position.

In our latest report, The No. 1 AI Energy Stock to Own Today.

This briefing also includes a second, bonus pick …

It’s a massive nuclear energy provider as well …

With 23 nuclear reactors across 14 plants currently active in the U.S.

And that’s not all …

The Company Fueling Nuclear Energy

Thanks to the nuclear energy renaissance …

There’s another company in prime position to capitalize.

Without getting deep into the weeds, nuclear energy is produced by a process called fission.

It takes place inside nuclear reactors, and it needs one vital resource above all …

Uranium.

There’s just one problem.

The U.S. isn’t producing enough of it.

That’s why, in March, President Trump issued a new executive order to increase American mineral production.

Part of an “Unleashing American Energy” initiative.

His administration is pushing for energy dominance.

And that means dormant uranium mines could soon be coming back online …

But it also means they’re not up and running yet.

This new dependency on nuclear energy is bullish for a small set of global uranium stocks.

Including one in particular.

It’s one of the largest uranium miners in the world …

Producing more than 30 million pounds a year.

But that’s not all …

It develops nuclear fuel products to generate electricity at reactors.

It also plans to be a go-to fuel supplier for existing reactors.

This means this company offers customers value along the nuclear fuel cycle.

From supplying uranium …

To turning that into enriched atomic fuel.

I don’t know how it works …

But I do know this company is one of the keys to the global nuclear energy revival.

The message is clear …

Nuclear power is no longer optional.

It’s absolutely necessary.

And as it continues to gain traction …

This company is well-positioned to maximize this accelerating shift.

Meaning its stock is likely to benefit from this nuclear energy renaissance.

I will send the name and ticker symbol for this unique stock pick.

As well as a bonus company also uniquely positioned to capitalize on nuclear energy’s growth potential over the next few years …

In this timely report, The Key to the Nuclear Energy Renaissance.

I’ll share how to get this briefing …

As well as our other urgent reports, AI Energy Saviors and The No. 1 AI Energy Stock to Own Today …

In just a moment …

But there’s one more opportunity tied to solving this long-term energy crisis I want to share …

The Future of Nuclear Energy

Now, I want to be upfront …

This is much riskier than anything else I’ve shared.

I’m actually a little hesitant to bring it up.

We’re talking about a moonshot possibility here.

This stock could make huge moves.

But it could also go bust.

It all has to do with the future of nuclear energy.

Look, reopening and retrofitting nuclear plants can only go so far …

Yes, those large reactors and plants are going to be a huge factor over the next several decades …

But the future of nuclear power is coming now.

And it looks incredibly different.

I’m talking about small modular reactors … SMRs.

These are mini reactors — the size of about two soccer fields — capable of generating up to 300 megawatts of energy.

They’re easy and cheap to build …

And it only takes 3-to-5 years to get them up and operational.

That’s up to 80% faster than most nuclear reactors.

They can be built closer to transmission lines or even be independent of the grid.

Most importantly, they can go anywhere.

Big cities, small markets, even isolated areas.

That’s why I like to call them “portable powerhouses.”

Rafael Mariano Grossi, International Atomic Energy Director General, said SMRs are "one of the most promising, exciting and necessary technological developments” in recent times.”

This could be a game-changer when it comes to the energy landscape over the next few decades.

The global SMR market is projected to explode more than 1,100% by 2033.

And Big Tech giants are getting into these projects as quickly as possible.

Amazon has already signed several deals …

It’s partnering with Ken Griffin, Ares Management Corporation and the University of Michigan to back X-Energy …

That’s a Rockville, Maryland-based SMR company.

It also has an agreement with Energy Northwest to develop several SMRs in Washington state.

While also partnering with Dominion Energy on a new project in Virginia.

Bill Gates is using SMRs for TerraPower, which is building a revolutionary Natrium plant in Wyoming.

And Google is partnering with SMR developer Kairos for several installations as well.

Rolls-Royce is building them in the U.K. …

While China and Russia already have working SMR units in the field.

Other countries are preparing for them right now.

That’s why the Department of Energy recently made $900 million available …

As part of Trump’s bold agenda to unleash American energy and AI dominance …

It’s unlocking the commercial deployment of American-made SMRs.

But here’s the deal …

They are still a few years away …

The first plants in the U.S. are not set to come online until 2030 at the earliest.

But there are two companies leading the charge when it comes to the mass SMR rollout headed this way.

The first was backed by OpenAI’s Sam Altman from the start …

Thanks to several major deals in place …

It is already a global leader in the SMR space.

And its portable powerhouses are ahead of schedule …

The first ones could begin operations in 2027.

Even though it’s been around for a dozen years …

It’s small, with a market cap of just $3.4 billion.

Which means, if its business does explode over the next few years as expected …

Its stock price could potentially benefit as well.

The second portable powerhouse company is miles ahead of its competitors.

It’s also at the forefront of this evolution in the nuclear industry …

Right now, it’s the only provider and producer of SMRs …

Whose technology has already received regulatory approval from the U.S. government?

With competitors in this space growing by the day …

Its unique first-mover advantage in the SMR market puts it well ahead.

With massive energy needs throughout the next few decades …

Nuclear reactors taking more than a decade to build …

And every Magnificent 7 CEO with their numbers on speed dial …

These two companies could be well positioned to benefit from a potential long-term growth opportunity.

You can read more about these two emerging nuclear energy firms …

And get their names and ticker symbols …

In this special briefing, Portable Powerhouses: Two Companies Leading the Rise of SMRs.

But first, let me introduce you to the man who identified each of these nine energy crisis solution stocks.

A Real-Life Indiana Jones

His name is Sean Brodrick.

And he’s spent the last three decades traveling around the globe …

Working to unearth the next great megatrends.

Often at some of the world’s most remote places.

Because you can’t do this just by staring at charts in a Manhattan corner office …

You can’t tell anything real about a company just by talking to their CEO over a phone …

You have to go out there and meet them. See these companies in person.

You need to get boots on the ground.

Oftentimes at some of the world’s most remote locations.

Sean’s been to the largest undeveloped gold mine in the mountains of Chile …

Panned for gold while avoiding bears in the Revelation Mountains in Alaska …

Searched for big gains as far north as Nunavut, Canada …

And traveled so far south identifying new growth opportunities that he had penguins running around him …

He’s inspected resource projects in Newfoundland …

Climbed on oil rigs in the Gulf of Mexico …

Even sat in an Aztec bowl used for sacrifices during the conquistador days …

And visited an ancient city of mummies when searching for silver in Guanajuato.

That’s why he’s often called the Indiana Jones of Mining.

He does all this because he’s not looking to uncover the same old dry investments everyone else recommends.

The safe boardroom kinds of stocks …

If you want to find the world’s next big megatrends …

You don’t do it just by having lunch meetings in the city.

You need to get your hands dirty …

Get your passport stamped a lot …

And get out in the field.

Now, of course, it’s not just expeditions to exotic locations.

Sean is also no stranger to calling up CEOs and industry insiders from his extensive Rolodex and asking tough questions …

While leveraging his considerable experience.

There are companies out there literally inventing the tech needed to make them billions.

These guys are cutting edge …

And you don’t truly find out what they are creating until you go out and see for yourself.

It’s been a huge commitment to stay ahead of these trends for sure.

But it’s paid off countless times …

That’s how Sean and his team have called the top and bottom of every single bull market of the last two decades.

When the government began printing and giving out money like candy in 2020 …

Sean was there to alert people that massive inflation was sure to follow.

The U.S. hit a new 40-year high immediately after.

Sean even called Trump’s first election back in 2015 …

When most people still thought it was a joke.

He even predicted the outbreak of the current war in Ukraine …

Before our own intelligence community said a word about it.

He has a long track record of spotting megatrends that other “experts” failed to see.

Now, he believes we may be at the start of a brand-new boom …

Brought about by fears over what could be a catastrophic energy crisis.

We are at the beginning of a monumental innovation cycle …

AI can reshape society and the economy …

But only if it has the power it needs.

That’s why Sean and his team have put together four vital reports:

- AI Energy Saviors

- The No. 1 AI Energy Stock to Own Today

-

The Key to the Nuclear Energy Renaissance

And …

- Portable Powerhouses: Two Companies Leading the Rise of SMRs

Nine stocks in all …

And they can all be yours as soon as the video ends.

So, how can you get your hands on Sean’s valuable research?

Welcome to Wealth Megatrends

We’ll send all four information-packed reports to you today.

All Sean asks is you give his monthly stock market newsletter, Wealth Megatrends, a try.

It gives readers the information to evaluate HOW and WHEN to jump on some truly earth-shattering ideas.

Sean and his team find stocks that play into the biggest trends …

Like this potentially life-changing global energy cycle that’s just beginning.

Never before in our lifetime have we witnessed more powerful and sustainable megatrends with the potential to change our world for the better.

That includes a broad array of innovative technologies, including driverless vehicles, the Internet of Things, cloud computing and the blockchain …

They are all working with each other to produce an ongoing cycle of growth and opportunity.

That’s why Sean calls this service Wealth Megatrends.

Look, all investing comes with risk …

Investors need to understand that while many investments come with a great upside …

They can also go down as well.

The smartest and most prepared investors do not play with money they cannot afford to lose …

And if you choose to invest, neither should you.

With that in mind, Wealth Megatrends is the absolute best resource for anyone looking to learn more about this potentially historic opportunity.

Sean doesn’t just close his eyes and throw darts at picks on the wall.

He and his team keep their fingers on the pulse of all economic, geopolitical, social and cultural megatrends that shape the markets, for better or worse.

With this kind of intelligence …

Backed by years of comprehensive experience …

Investors can unlock the door to some of the most exciting and unique opportunities available today.

Sean’s not looking to find some fad “meme” stock.

He only wants the cream of the crop.

Each stock Sean picks is backed by thousands of data points and professional analysis.

On the third Friday of every month, you will receive your latest issue with a new recommendation on the freshest stock market megatrends.

But you get so much more than stock picks …

The markets move fast, so investors need to be prepared for quick changes.

That’s why every Wealth Megatrends member also receives Sean’s “Flash Alert” emails covering the latest risks and opportunities.

For really important events, members will also receive an invitation to his confidential online briefings …

Where he’ll answer general market questions live on the air …

And share predictions for what the next quarter could hold.

You’ll also receive his free Weiss Ratings Daily E-Letter.

It’s the most detailed and timely way to stay on top of new developments in the market, and it’s included at no additional cost.

But just in case you’re still on the fence, there is one more report that Sean wants me to share with you today …

We’ve already shown you how natural gas, nuclear energy, uranium and SMRs are all well positioned to perform …

Thanks to AI, data centers and the exponential growth in power needed by both.

But Sean also recently identified another massive cycle that could be set to explode right now …

How to Leverage Gold Holdings Without Buying Another Ounce

With decades of experience in the gold market …

Sean’s opinions in this sector are regularly sought after …

He’s spoken at the New Orleans Investment Conference …

At multiple MoneyShows in Las Vegas, San Francisco, Orlando and Miami …

As well as the Metals Investor Conference in Vancouver …

Sean correctly called gold’s most recent rise to $3,200 …

Nearly to the day.

It was right after the election.

Now, Sean says gold is well on the way to his second, much higher target.

More than double what it is now … $6,900.

And he’s not the only one excited about gold …

Costco can’t keep it on their shelves as everyday Americans are clamoring for it …

Many of the world’s smartest investors …

Billionaires like Ray Dalio, David Einhorn and John Paulson …

Are piling in.

But here’s the thing …

Even with gold soaring to new highs …

Its price has only climbed 29% this year.

Meanwhile, Sean has identified what he believes could be an even better way to take advantage of moves in the gold market.

I’m talking about a little-known way that has provided investors an opportunity to outperform physical gold.

Without buying another ounce.

This has nothing to do with risky options trades …

Instead, it’s a simple investment that investors are utilizing to leverage the rising popularity — and demand — of gold.

Sean details everything in his exciting new report, 5 Essential Gold Stocks for the Bull Market.

Inside, he walks you through the entire process and shows you exactly how you can get involved.

As soon as this broadcast is over, I’ll rush you a copy of 5 Essential Gold Stocks for the Bull Market.

As well as copies of the other four reports I mentioned:

AI Energy Saviors.

The No. 1 AI Energy Stock to Own Today.

The Key to the Nuclear Energy Renaissance.

And Portable Powerhouses: Two Companies Leading the Rise of SMRs.

Those are yours as a bonus — when you subscribe to Wealth Megatrends.

I know this is a lot …

So, let’s quickly summarize what this comprehensive AI Energy Saviors package includes:

Today, as part of your membership with Wealth Megatrends, you will receive:

- BENEFIT #1. AI Energy Saviors (Sold separately for $79)

- BENEFIT #2. #1 AI Energy Stock to Own Today (Sold separately for $79)

- BENEFIT #3. The Key to the Nuclear Energy Renaissance (Sold separately for $79)

- BENEFIT #4. Portable Powerhouses: Two Companies Leading the Rise of SMRs (Sold separately for $79)

- BENEFIT #5. 5 Essential Gold Stocks for the Bull Market (Sold separately for $79)

- BENEFIT #6. A full 12 months of access to Wealth Megatrends (sold separately for $109)

- BENEFIT #7. Sean’s Weiss Ratings Daily E-Letter, sent to your inbox 5X weekly

- BENEFIT #8. Sean’s flash alerts for critical, time-sensitive market movements (priceless)

- BENEFIT #9. An exclusive invitation to Sean’s confidential online briefings

- BENEFIT #10. Huge savings! The total value of this package is $732.

- BENEFIT #11. Sean’s 100% Unconditional 365-Day Money-Back Guarantee

With the 14 stocks detailed within these five comprehensive reports, you’ll have a real chance to capitalize on the solutions to this impending AI energy crisis …

As well as the information you need for an opportunity to take advantage of the current gold surge.

And Sean consistently keeps you updated on significant changes in the market, so you can make more informed decisions throughout the year.

So how much does Wealth Megatrends cost?

Less Than a Tank of Gas

A year’s subscription to Wealth Megatrends normally retails for $109.

But Sean doesn’t want you standing on the sidelines as an opportunity like this rolls by.

So today, anyone watching can get a full year of access to everything covered here for just $49.

That’s less than the cost of one tank of gas.

I think you’ll agree that is more than fair, given the kind of megatrend stocks you’ll have access to.

Sean and his team will share what they believe to be the best stocks to invest in every step of the way.

And if you aren’t satisfied for any reason during your first 12 months …

Just contact Sean’s team and they’ll provide a full refund with no hassles.

That means a full year to try out and enjoy Wealth Megatrends.

So, if you missed out on the early pop in AI stocks, don’t worry.

Contrary to what the media wants to tell you.

They aren’t going way.

And now, Sean has found what he believes is an even better way to play AI’s rise to prominence than the same stale Magnificent 7 stocks.

Act now to subscribe to Wealth Megatrends and get immediate access to his AI Energy Crisis Solution package right away.

Click the button below to review our offer.

This AI energy crisis is real and it is coming, but it also means that there’s a great deal of opportunity coming your way too.

And Sean will be here to lead the way.

Thank you all for joining us.

Sincerely,

Chris Hurt, Host

Wealth Megatrends